100% Electric Vehicles = 12% Of New Car Sales In Europe In January – CleanTechnica

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

The European passenger plugin vehicle market scored 199,000 registrations in January. Positively, BEVs (+29%) continued to grow despite the drop in EV incentives in a number of markets. Plugin hybrids (PHEVs) were also on the way up, growing by 23% year over year (YoY). BEVs started the year solidly ahead of PHEVs (61% BEVs vs. 39% PHEVs).

Because the overall market is also recovering (+12% YoY to over one million units), the 2023 BEV share started the year at 10%.

Regarding other powertrains, plugless hybrids were up from 26% share in January 2023 to 29% in January 2024, while petrol was down 2% YoY to 36% and diesel continued its slow drop into the abyss, falling from 16% a year ago to its current 12%. At this pace, expect diesel sales to end around 2027….

Also, this meant that 49% of all passenger vehicles sold in January in Europe were electrified (to some degree).

Still, with the BEV share starting at 12%, expect the plugin market to recover from January’s incentives blues and end the year with 30% plugin share, with BEVs having two thirds of that, or 20% share of the overall auto market.

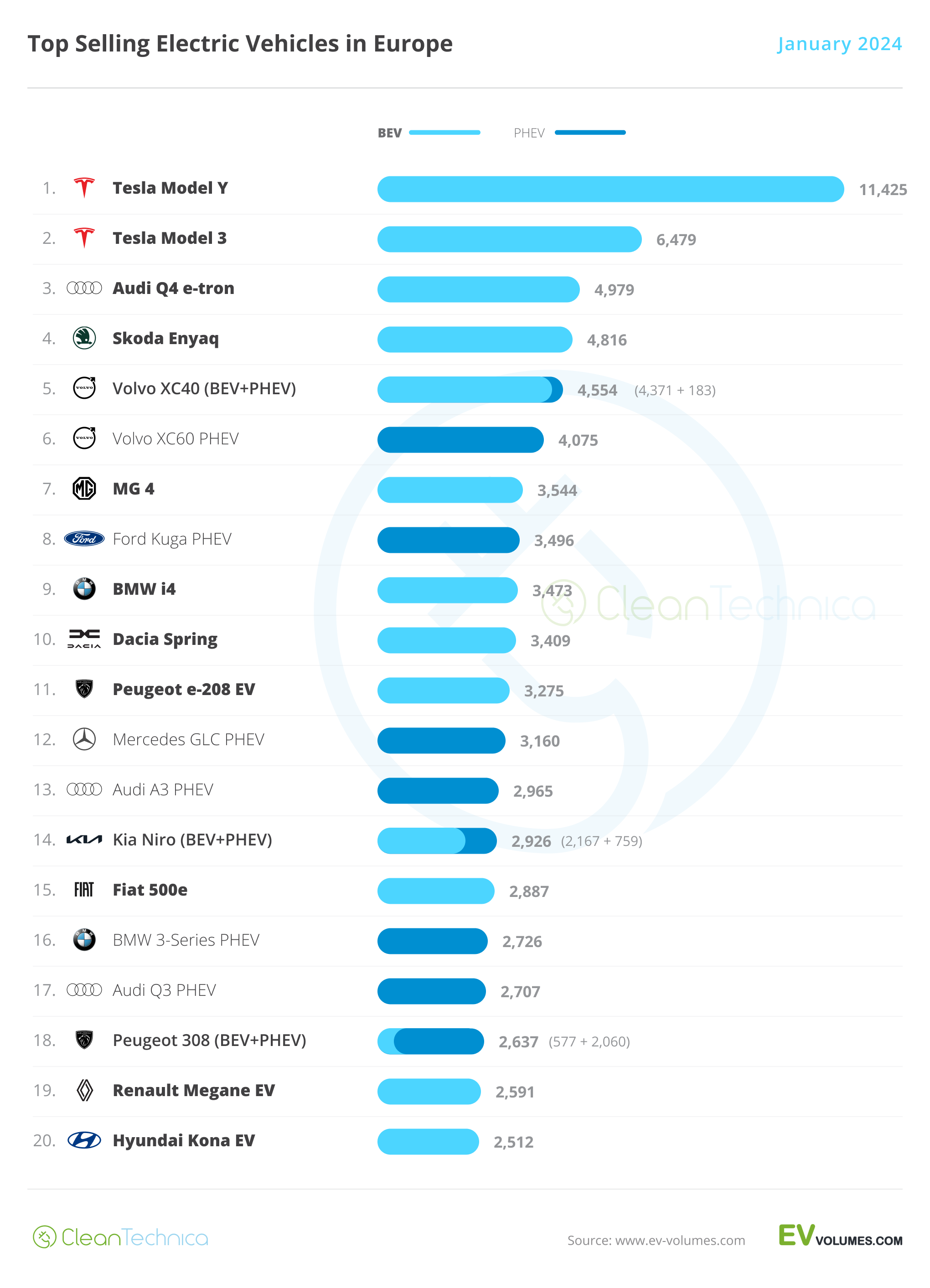

In January, with Tesla starting the year at full speed and some of the heavyweights (Volkswagen …) still hung over from the end-of-year peak, it was time for a few surprises at the top of the table. One interesting fact is that 4 out of the top 5 models were crossovers, which says a lot about what is hot right now.

Bring on the popcorn, because the next few months will surely be fun to watch!

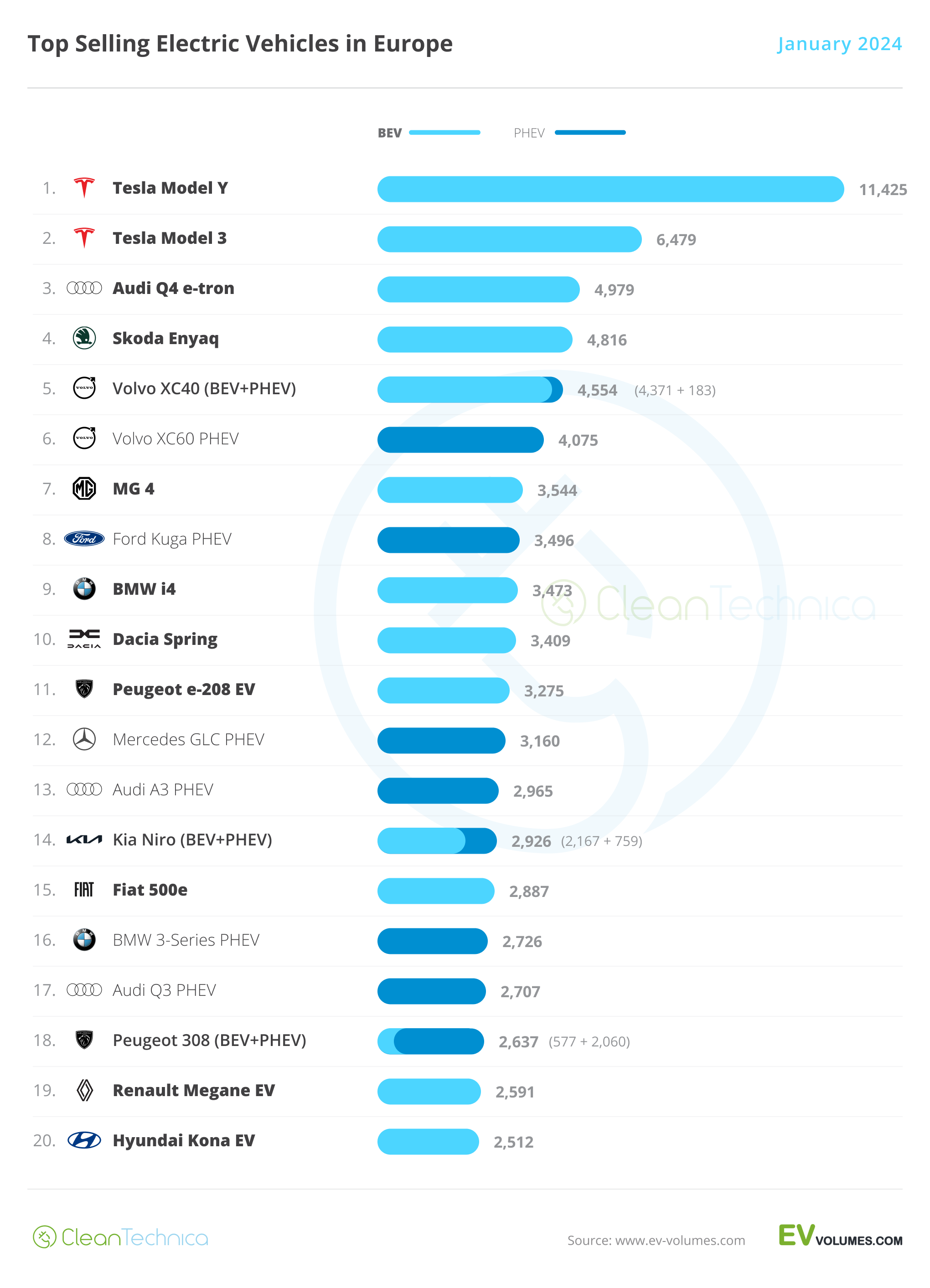

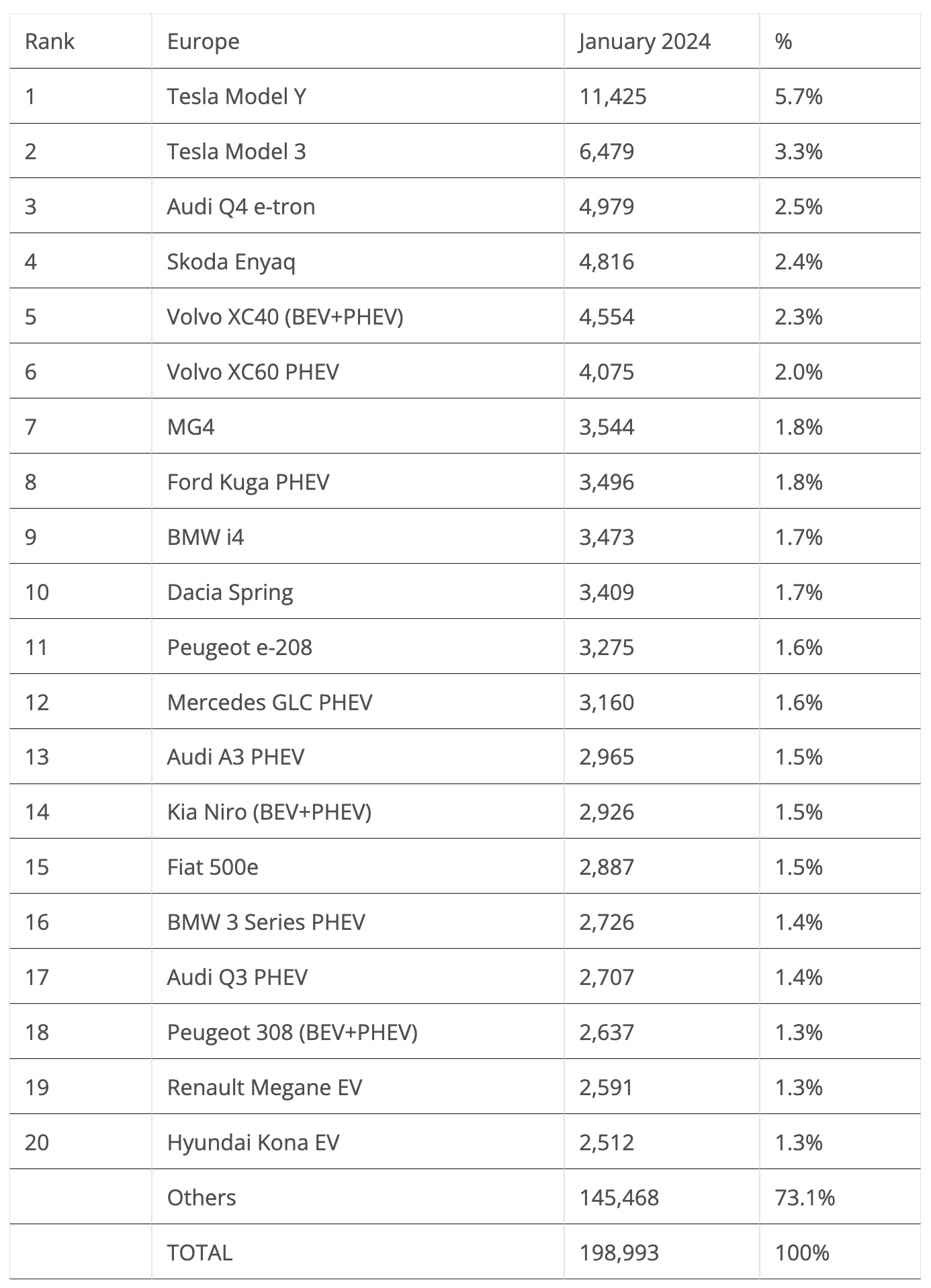

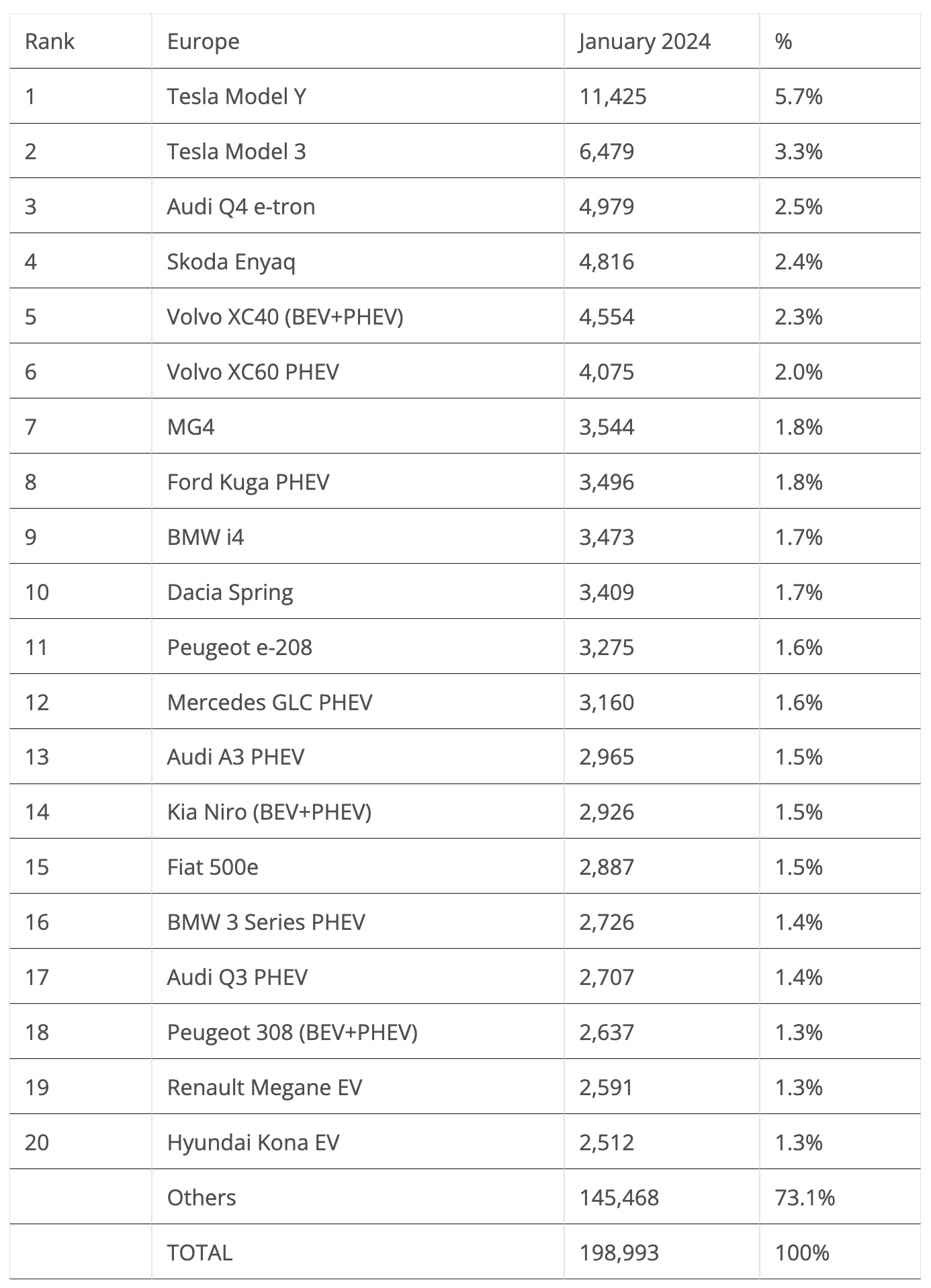

Looking at the monthly model ranking:

#1 Tesla Model Y — Tesla’s crossover scored 11,425 registrations last month, which allowed last year’s best selling model in Europe to start again in the lead, helped by recent price drops. Looking back at January’s results, the main market was by far Germany (2,293 registrations). It was followed at a distance by France (1,477 registrations), the Netherlands (1,141 registrations), and Belgium (430 registrations).

#2 Tesla Model 3 — The made-in-China sedan was the runner-up model, with 6,479 registrations, allowing a gold plus silver win for the US make. With the refresh allowing the sedan to recover sales, Tesla is looking to have both models in the top two positions by the end of the year. Looking at individual countries, sales were heavily based in France (1,623 registrations), followed from afar by Germany (695 registrations), the United Kingdom (770 registrations), and Spain (737 registrations).

#3 Audi Q4 e-tron — The most popular German model hit 4,979 registrations last month, making it the best selling model based on the MEB platform. The compact Audi is benefitting from Volkswagen Group prioritising the more expensive/profitable MEB models. Regarding January performances, the Audi crossover’s registrations were mainly distributed over the following countries: Germany (1,424 units), the United Kingdom (1,050 units), and Belgium (728 units).

#4 Skoda Enyaq — The 4,816 deliveries of January didn’t allow it to start the year on the podium, but this is nevertheless a good score, so expect the Czech model to continue being a frequent presence in this top five. Regarding January, Germany (1,457 units) did the usual heavy lifting, with the UK a distant 2nd with only 610 registrations, and Belgium 3rd with 518 units.

#5 Volvo XC40 (BEV+PHEV) — With electrification high on Volvo’s priorities list, the Swedish brand is, along with Porsche, one of the two most electrified legacy automakers in Europe. So, it’s no wonder the XC40, it’s only model with BEV and PHEV versions, is the brand’s sales champion. The compact SUV hit 4,554 registrations last month, with most of them coming from the BEV version (4,371 units), highlighting the growth prospects of the brand on the BEV side — especially considering the arrival of the much anticipated Volvo EX30, the brand’s first dedicated BEV. And that’s when the fun begins…. Getting back to the XC40, the major markets were the Netherlands (1,021 registrations), Belgium (797), Sweden (567), and the UK (520).

Outside the top 5, a mention is due for the strong month that BMW had. Not only did the fully electric BMW i4 get a top 10 presence (it was 9th, with 3,473 sales), but its PHEV counterpart, the BMW 3 Series PHEV, was 16th, with 2,726 sales. Counted together, that would place the BMW midsize offerings (6,199 units) at the same level as the Tesla Model 3!

The second highlight was Peugeot. Besides the return to form from the small e-208 (11th with 3,275 sales) — with the ramp-up of the refreshed units allowing the French model to score its best score since September — its bigger sibling the 308 hatchback had a record month, 2,637 sales, allowing it to join the table at #18. That was in part thanks to the delivery ramp-up of the BEV version, which had 577 sales in January.

Regarding fresh faces, the Hyundai Kona EV, now in its 2nd generation, joined the table at #20. Expect the electric crossover to be the Korean brand’s star player in Europe.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Outside the top 20, a few models deserve a mention, like the first volume month of the Volvo EX30. The new Volvo started its career with 2,244 sales, so expect Volvo’s small crossover to joint the table soon. Now, the question is: Will the EX30 success mean the sales demise of the brand’s current sales champion, the XC40?

In the Volkswagen Group stable, and highlighting the namesake’s slow month (and Audi’s strong performance), the big, expensive Audi Q8 e-tron was at #21, with 2,507 sales, ending ahead of the VW’s ID.3 (1,998 sales) and ID.4 (2,227 sales).

Some final food for thought for policymakers in Europe: Only four models in this top 20 (the MG4, Peugeot e-208, Fiat 500e, and Dacia Spring) sit below the €35,000 threshold, so it is evident that EVs are skewed towards the higher priced segments. As such, to counter the “EVs are for the rich” argument, I think it is time for policymakers to consider reducing EV incentives to vehicles below €30,000, but also start taxing big, heavy EVs so that the argument that “EV incentives only benefit the rich” becomes muted.

Will cutting EV incentives to only €30,000 and cheaper cars mostly benefit Chinese automakers? Maybe at an initial stage, but it will also force local OEMs to fast forward their production plans for cheap EVs (the Volkswagen ID.2 is just one example).

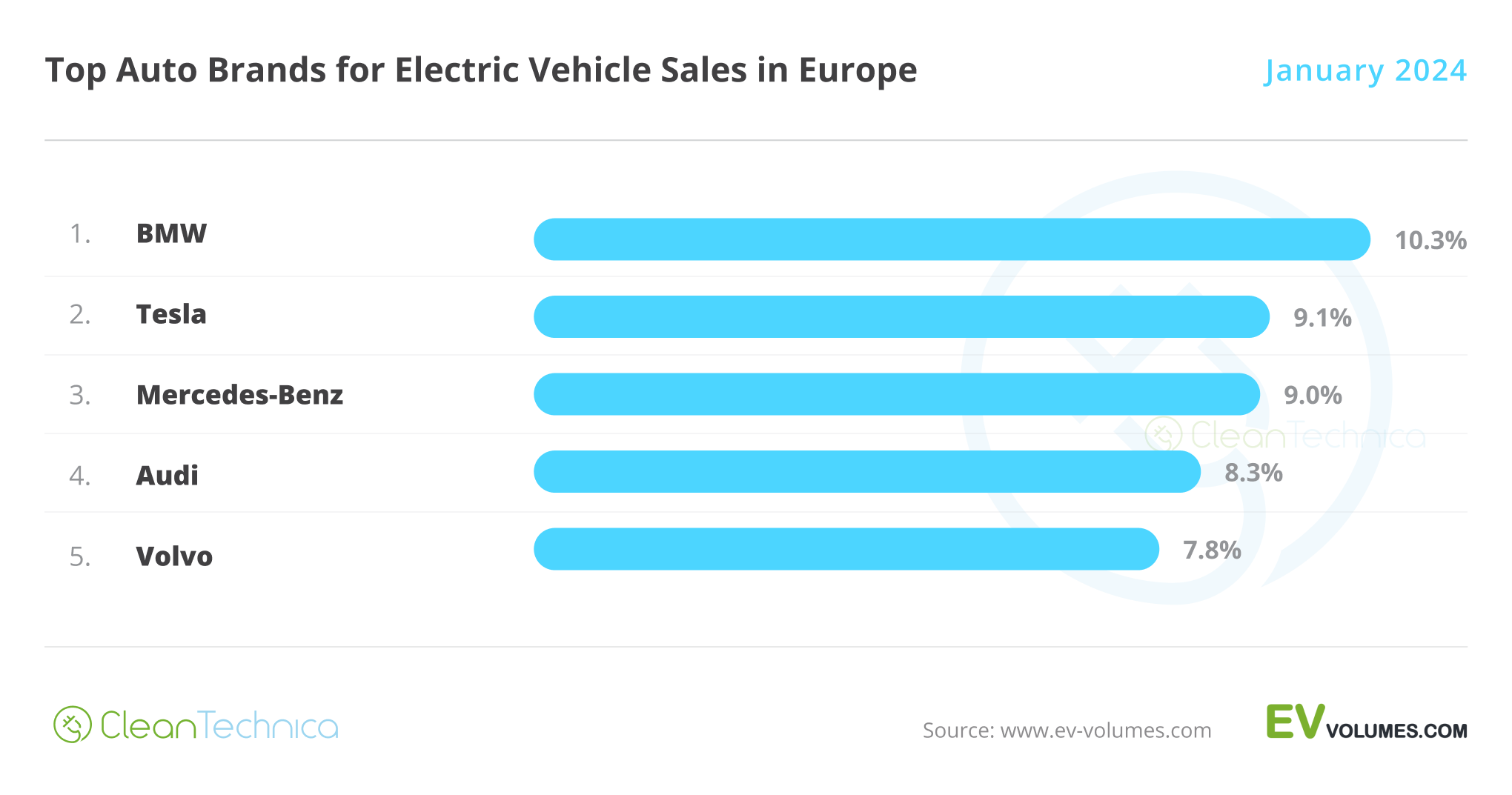

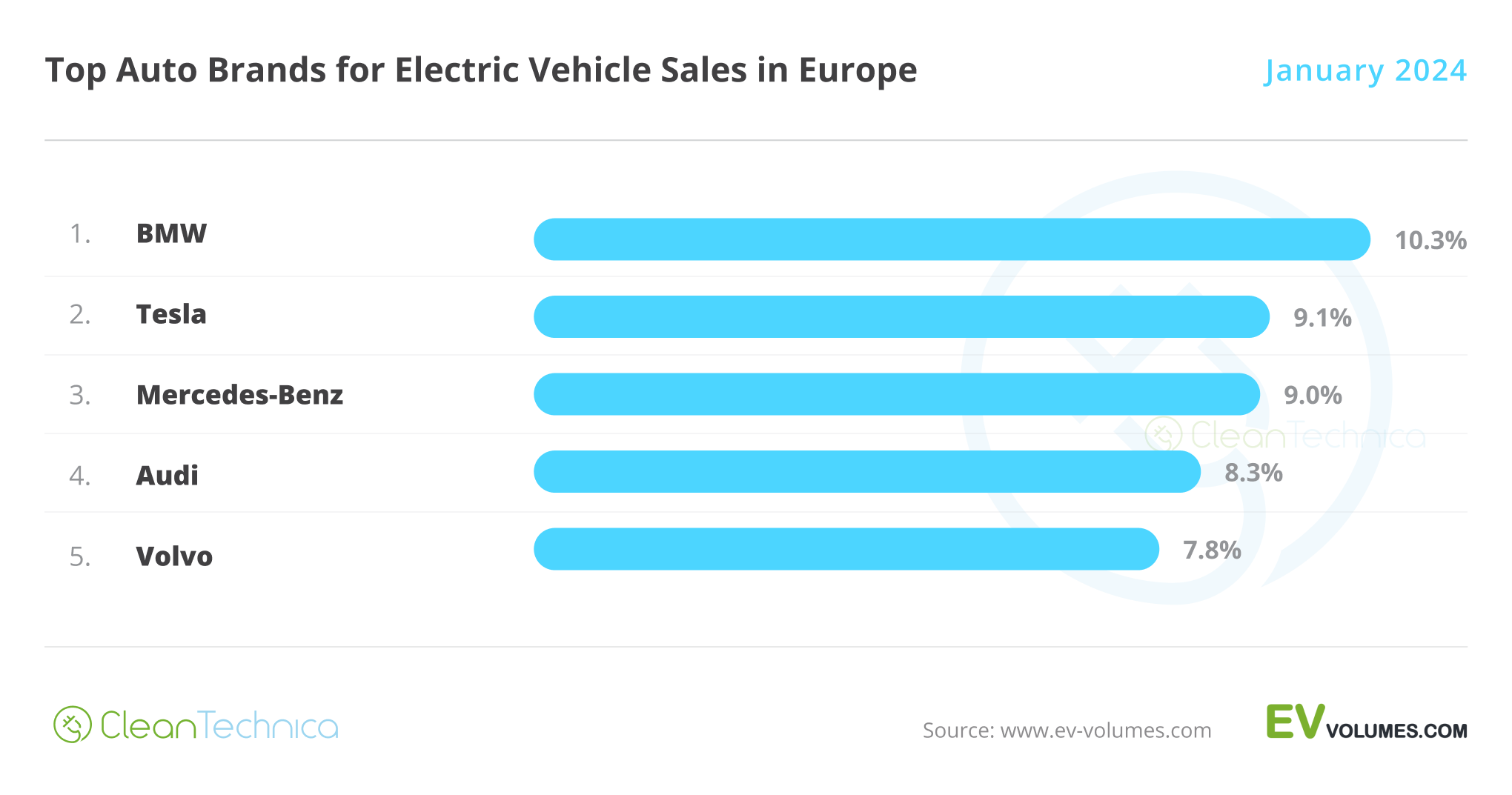

In the manufacturer ranking, balance is the word. BMW (10.3%) started in the lead again, followed by Tesla (9.1%) and Mercedes (9%) in second and third, respectively. They were followed closely by Audi (8.3%) and Volvo (7.8%), so expect Tesla to return to the top by the end of March — although, BMW won’t be far off.

Outside the top 5, we have #6 Volkswagen and #7 Kia with just 5% share. The German brand started the year in the slow lane, but expect it to return to the top five soon.

Peugeot was 8th, with 4.8% share, but unlike Volkswagen, the French brand does not seem to have the same potential to join the top five soon.

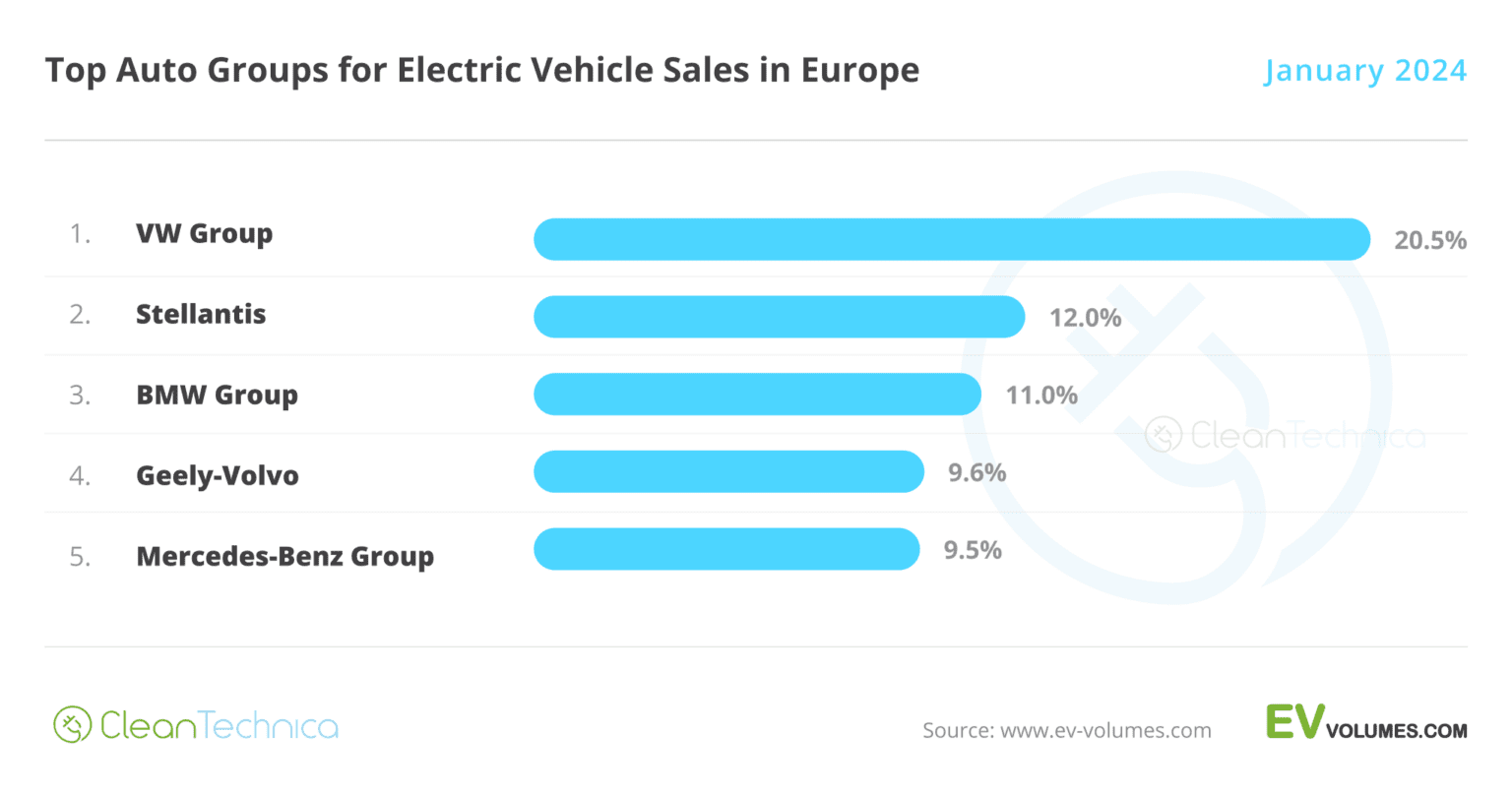

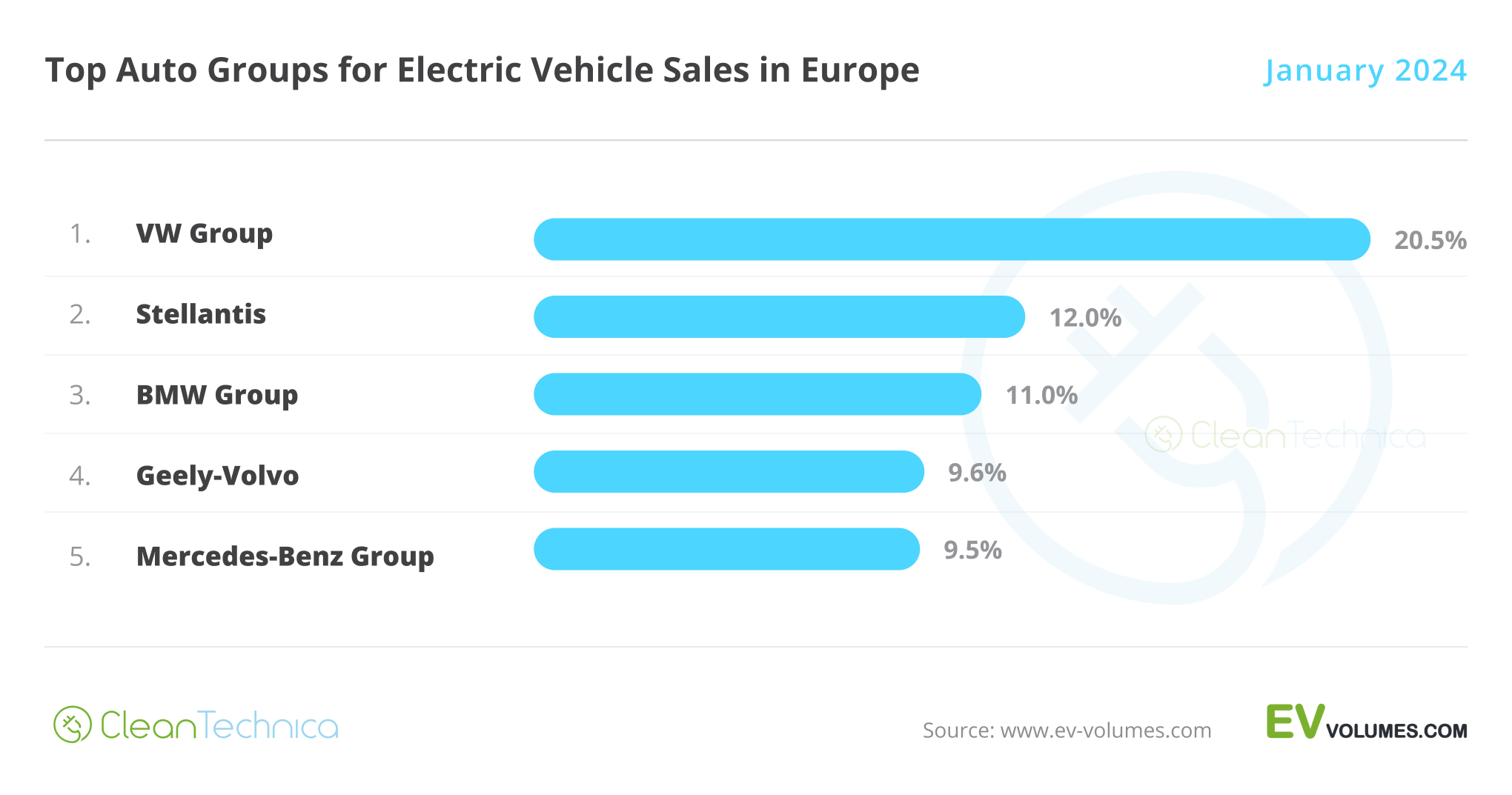

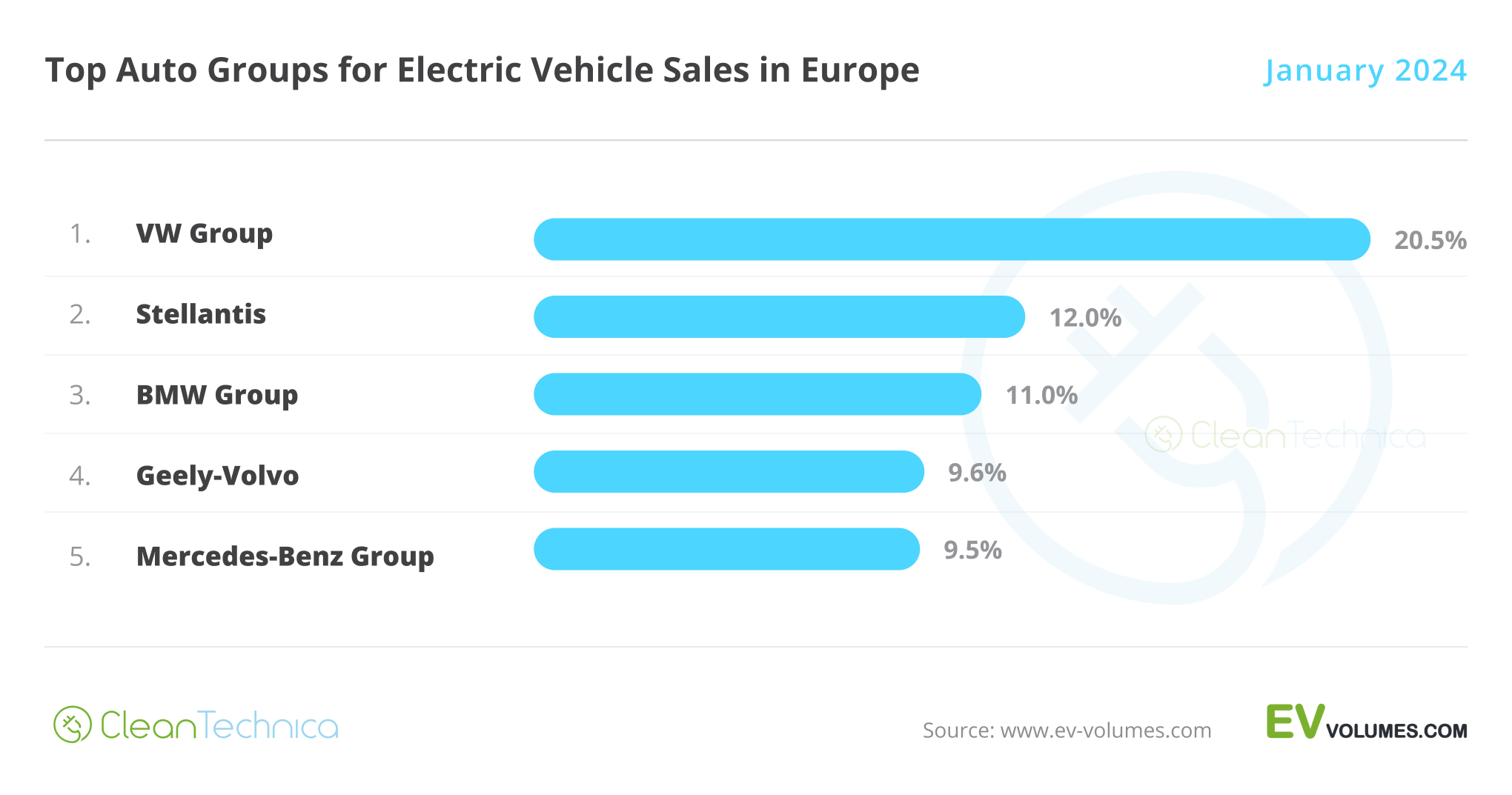

As for OEMs, Volkswagen Group started the year in front (unsurprisingly), with 20.5% share. That’s down slightly from 20.7% in January 2023. Runner-up Stellantis is at a distant 12%, which is down from the 14.1% of January 2023. So, the German conglomerate looks poised to have another easy win in 2024.

BMW Group (11%) started the year in the 3rd position, up by 0.7% share compared to its January 2023 standing. That meant kicking Geely–Volvo (9.6%) off the podium to 4th.

Below those OEMs, Mercedes-Benz was 5th, scoring 9.5% market share. #6 Tesla (9.1%) should gain a couple of positions, and #7 Hyundai–Kia (8.7%) also has hopes for getting to a top 5 position.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

CleanTechnica uses affiliate links. See our policy here.