IN² At 10 Years: How It Started, How It’s Going, What’s Next, & Beyond – CleanTechnica

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

For its 10th anniversary, the Wells Fargo Innovation Incubator (IN2) is expanding in a major way.

“We are moving along with the rest of the market—which is all about deployment,” current IN2 Program Manager Sarah Derdowski said. “One of the hardest challenges in the cleantech industry is overcoming that last ‘valley of death,’ which is adoption. The expansion allows us to help adopters as well as startups tackle some of their biggest barriers—we are connecting the dots from nascent startup technology all the way through adoption. The goal is accelerating the pace by reducing barriers for startups and adopters.”

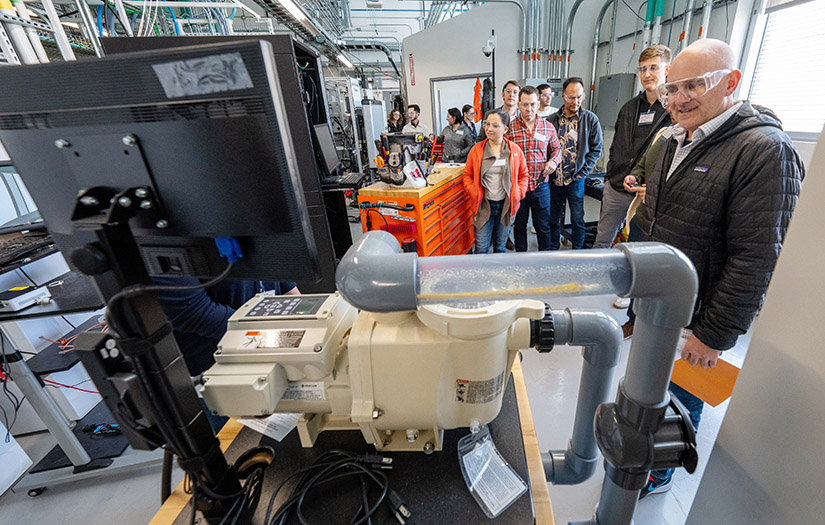

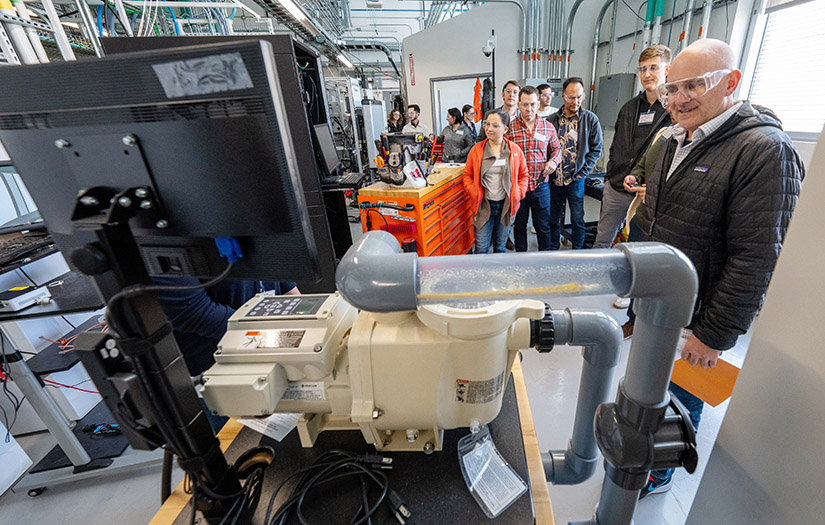

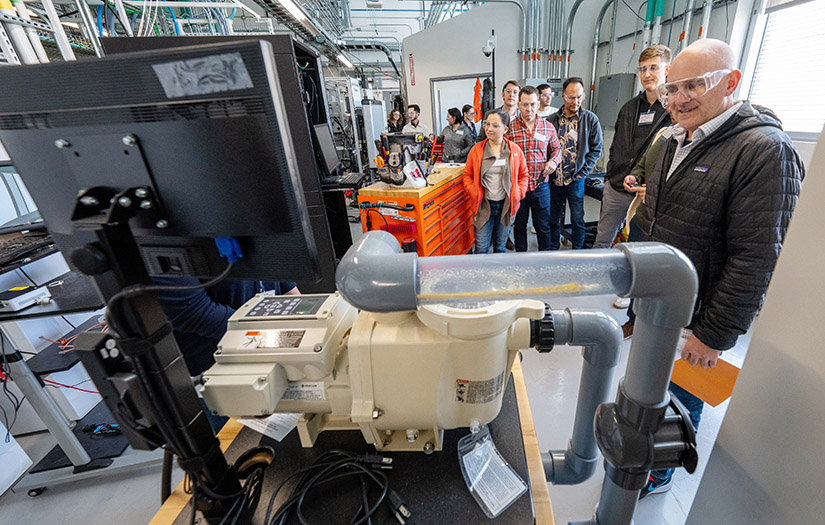

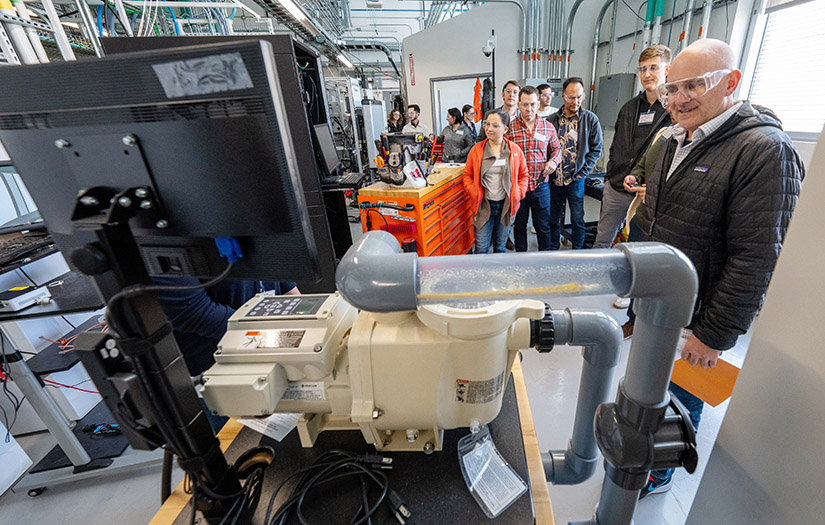

IN2 is managed by the Wells Fargo Foundation and the U.S. Department of Energy National Renewable Energy Laboratory’s (NREL’s) Innovation and Entrepreneurship Center (IEC). Over the past 10 years, IN2 has supported 12 cohorts of startup companies with up to $250,000 each in nondilutive funding. The companies use those funds to work with the world-class experts at NREL and the Donald Danforth Plant Science Center in St. Louis to improve, validate, and de-risk their technologies. Applicants are referred by the Channel Partner network, a group that includes more than 60 incubators, accelerators, and universities who collectively have access to more than 6,000 startups.

In 2024, IN2 is evolving with a new track designed to help deploy clean energy technologies. The plan is to partner startups—potentially IN2 program alums—with companies and communities that want to adopt clean energy technologies. While the program will look to IN2 alums first, the key will be finding the technology each adoptee needs. The funding from IN2 will help the startup install its technologies into one of the partner’s locations and provide a targeted curriculum for the adoptees to give them the knowledge needed to uptake the new technology. For this first cohort on the new track, IN2 will find industry partners across a broad spectrum:

- Large corporation or grocery chain

- Mid-size company in real estate

- Nonprofit and/or government entity

- Community—county or city

- State government.

“Through this pilot, we’re going to be able to answer the question: Can we get industry really connected in with what we’re doing on the startup side?” IEC Director Trish Cozart said. She is also a former program manager of IN2. “This new track gathers industry involvement in innovation in a much deeper way.”

The plan is for the new track to bring in its first cohort in summer 2024.

“The amount of experience and knowledge NREL has is incredible,” said Tim Meanock, CEO and co-founder of Tallarna, an IN² portfolio company. “But it’s their great processes that set them apart. The lab provided us with a first-class way to take our software to the next level, and they coupled this with market references.”

How It Started

Kate Moore, current head of partnerships, innovation, and entrepreneurship for NREL, took on the role of the first program manager for IN2.

“It started because Wells Fargo wanted to support the clean energy ecosystem,” Moore said. “They were already working with business incubators around the country but learned there wasn’t a great process to qualify the technical feasibility of promising solutions to scale. They leveraged NREL’s unique expertise by developing a first-of-its-kind public-private partnership.”

“The overall mission was to help clean technologies navigate the crevasse from startup-in-the-garage to commercialization,” said Curt Radkin, Wells Fargo executive director for corporate properties sustainability strategy. “This idea of having NREL manage the program and validate the technologies was super attractive for us to help these companies navigate the path to market.”

The work with IN2 inspired many NREL researchers, and the relationships between NREL scientists and startups often continue after their time with IN2 is complete. This could be in the form of follow-on funding or just staying in touch to keep sharing information about the evolving technologies. That relationship is key to IN2’s ongoing success.

“This partnership is built on a collaborative model where both the startup and the researcher are informing a commercialization project to move the needle,” Moore said. “It’s really rewarding for researchers because they can immediately see their impact, and they gain all sorts of market insights.”

According to Associate Laboratory Director for Innovation, Partnering, and Outreach Bill Farris, one meeting early in the creation of the program stood out even a decade later.

“It was just a fantastic meeting to witness,” Farris said. “We brought bankers, who knew about capital and how important that was to fuel a business; entrepreneurs, these bright folks with big ideas; and then NREL with our R&D tool set. It was a magical meeting because they all got along really well. It showed the complementary aspect of those three pieces.”

“IN² helped us jump this from a cool laboratory idea to where it could be transformational for the industry,” Blue Frontier CEO Daniel Betts said. Blue Frontier is also an IN² portfolio company. “We built it, and we sent it to NREL, and they tested it. From that, the performance of the unit allowed us to move forward to field trials and early manufacturing with quite a bit of alacrity and confidence that we know what we’re doing.”

How It’s Going

The success of companies that participate in the IN2 program is tremendous. The 72 startups have collectively raised more than $2 billion in follow-on capital and achieved a 101% leverage rate. That means for every $1 invested the portfolio companies raise more than $101. This comes less than three years since the companies broke through the $1 billion mark in follow-on funding.

“That just proves we’re betting on the right technologies,” Wells Fargo Chief Sustainability Officer Robyn Luhning said. “We’re also providing them with the expertise that they need to succeed. Pinpointing the secret sauce is difficult, but I think it hinges on harnessing NREL’s world-class expertise and facilities.”

The success of IN2 helped the IEC create additional, similar programs, like the Shell GameChanger Accelerator Powered by NREL (GCxN), Chevron Studio, and more. IN2 is a model for each new program, but the team creates a system that meets each funder’s unique needs.

“It’s great to see that we built something that works so well by pairing the prestige of NREL with the price point that’s going to give us the greatest return,” Cozart said. “I’m thrilled that this model is so great, others want to emulate it.”

Farris believes a major reason for the success is the quality of the partnership with Wells Fargo.

“We are unique in the industry to get the kind of results that we have,” Farris said. “We tell everybody what we do with IN2 because we’re so proud of it. It is a relatively simple recipe, but it’s still proven to be unique.”

Because of its success, IN2 has quite a reputation nationwide, including at Wells Fargo.

“It’s something that sets Wells Fargo apart from some of our peers and competitors,” Radkin said. “I’m proud to have been able to play a role and contribute.”

“Our work with NREL highlighted what’s possible and set the bar from an energy modeling standpoint,” said Darcy Solutions co-founder and CEO Brian Larson. Darcy Solutions is also a member of the IN² portfolio. “It also provided us with another level of credibility and showcased the market opportunity.

What’s Next?

Introducing the new track for IN2 is a major step forward, but those involved believe it makes sense for the program as it embarks on a new decade.

“It’s the right next step at the right time,” Radkin said. “When looking at program alumni, we knew we had to better leverage the bank’s relationships to try and expose others to this amazing clean energy technology. With all these corporations making 2030 and 2050 initiatives, the appetite is right.”

It is no secret that the cleantech industry is full of startups that struggle to scale up, but that is precisely what the new IN2 track hopes to target and overcome.

“The last 10 years have been really focused on growing the supply of needed solutions,” Moore said. “This new parallel track now starts to build out the demand side. We’ve got all these amazing technologies; how do we actually get them implemented?”

The plan is for the new track to bring in its first cohort in the fall of 2024.

“It’s quite fantastic that you can get the kind of results that we’ve gotten,” Farris said. “Find good companies and turbocharge them, and they are off on a path to success.”

“Having reports from NREL enabled us to scale,” said Brian Chang, product marketing manager for Turntide Technologies, a member of the IN² portfolio. “We are bringing something new to the market. Third-party validation allows us to leverage unbiased and convincing proof points when we’re discussing our technology with new customers.”

And Beyond

Wells Fargo also plans to increase its own adoption of technologies produced by IN2 startups. The company has 70 million square feet of real estate across the globe and has already completed a demonstration with Turntide Technologies.

“We’re actually in the process now of figuring out how to scale and deploy that technology and building it into our 2025 budget,” Radkin said.

Additionally, Wells Fargo is working in partnership with a major utility to pilot Blue Frontier’s transformational air conditioning technology in one of its retail branches. Through IN2, NREL validated the technology to be three times more efficient than traditional air conditioning, depending on climate zone.

“IN2 is such a good model for creating a good relationship with the lab and an outside partner,” Derdowski said. “IN2 has never been stagnant. It’s evolving with the needs of the startups and the market.”

“When we went out in the community to ask people to work with us and use our technology, because of IN², we knew it was going to work,” said Shifted Energy co-Founder and CEO Forest Frizzell. Shifted Energy is also a member of the IN² portfolio.

Learn more about the IN2 program.

Article from NREL. By Jeffrey Wolf

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.