25% Of New Vehicle Sales Plugin Sales In Germany In 2023! – CleanTechnica

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

30% plugin vehicle share in December!

The German plugin market experienced a somewhat chaotic year in 2023, all due to subsidy cuts. First it was the subsidies cut to PHEVs, which started on January 1st, 2023, and led to plugin hybrids crashing in 2023. The year ended with a 52% drop in PHEV registrations, to 175,724 units, representing just 6.2% of the overall market.

Then, on September 1st, 2023, subsidies ended for BEV company cars, which created a delivery peak in August, usually one of the slowest months of the year, followed by a short hangover. Because subsidies to private buyers were also supposed to end by the end of December, another delivery peak was supposed to happen in the last month of the year.

Only … in a very un-German kind of way, on Saturday, December 16th, the local government decided to end those EV subsidies earlier than expected, on Monday, the 18th. … Despite some brands discounting the value of the subsidy in the days that followed the abrupt subsidy cut, the truth is that the sales peak wasn’t as big as originally expected, with December ending at 54,654 BEV registrations.

As such, BEVs scored an okay 23% share of the auto market in December, which added to the 7% on the PHEV side, leading to a 30% plugin share. The full-year 2023 numbers ended at 25% (19% BEV), which is a 6% drop over the 2022 numbers (31% share). Although, looking on the bright side, despite the subsidy cuts, the 2023 BEV share (19%) was up 1% compared to the 2022 result (18%), jumping a nice 6% over the country’s 2021 BEV result.

Looking at the BEV vs. PHEV breakdown, there was also good news, with the former solidly outselling the latter. The sales breakdown between the two changed dramatically, from the 56% BEV vs. 44% PHEV of 2022, to the current 75% BEV vs. 25% PHEV. Expect PHEVs to rebound a little in the beginning of 2024, but the overall trend is for them to progressively lose relevance.

In the year of 2024, especially the first half, expect BEVs to experience a small sales hangover, which should be balanced in the second half of the year. We might see this market surpass the 20% BEV share threshold towards the end of the year.

But the year for real growth in the German EV market shouldn’t be till 2025, when the local premium OEMs will launch their true volume EVs (BMW Neue Klasse midsize EVs, Mercedes CLA EV, Audi A4 e-tron…) and VW will launch the much awaited VW ID.2 small hatchback. And even the honorary German Tesla might have its compact offering ready by that time.

This should allow the German passenger car market to become 100% BEV by the time the 2035 100% ZEV mandate from the European Union kicks in. Of course, all this is assuming that future governments do not change the rules of the game.

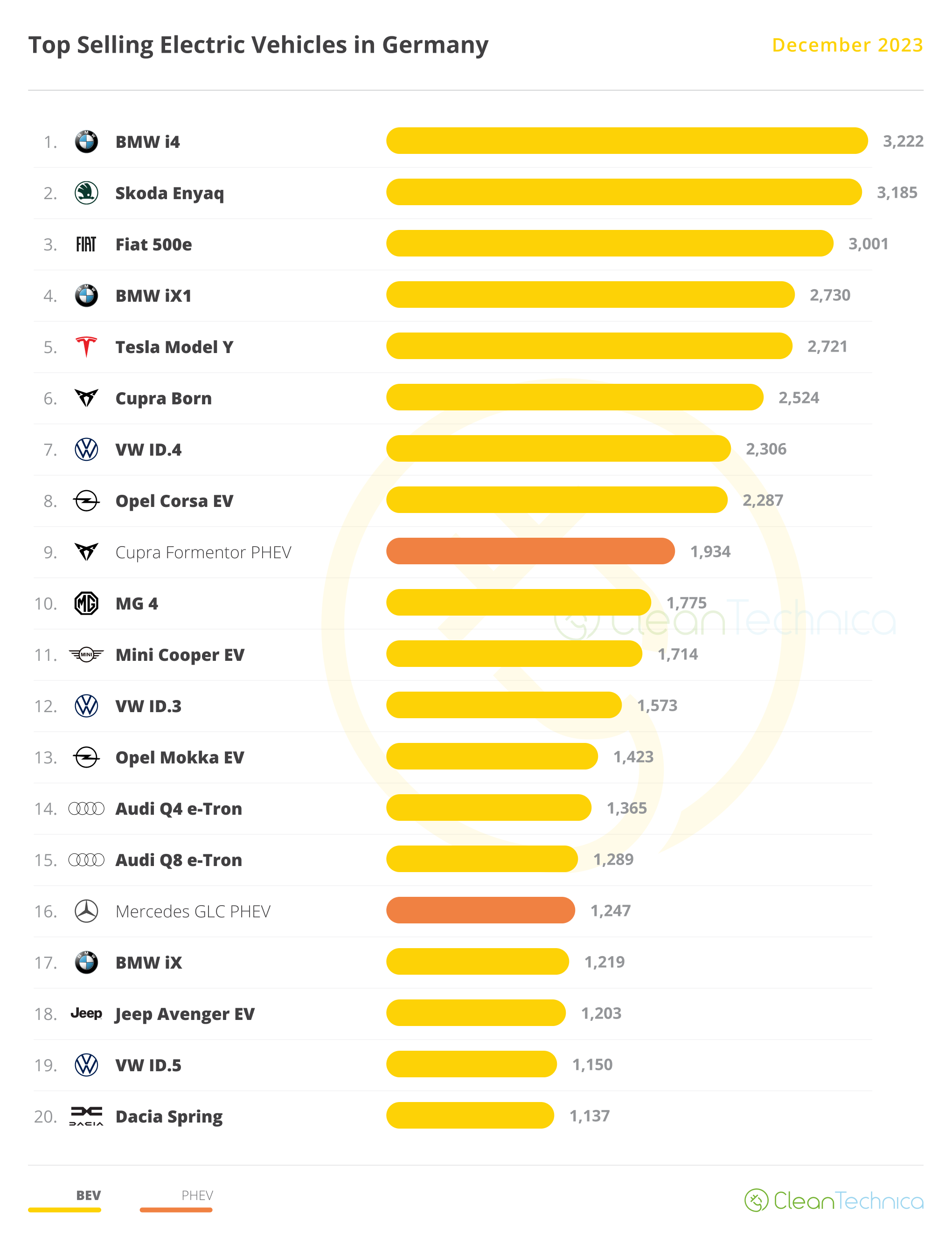

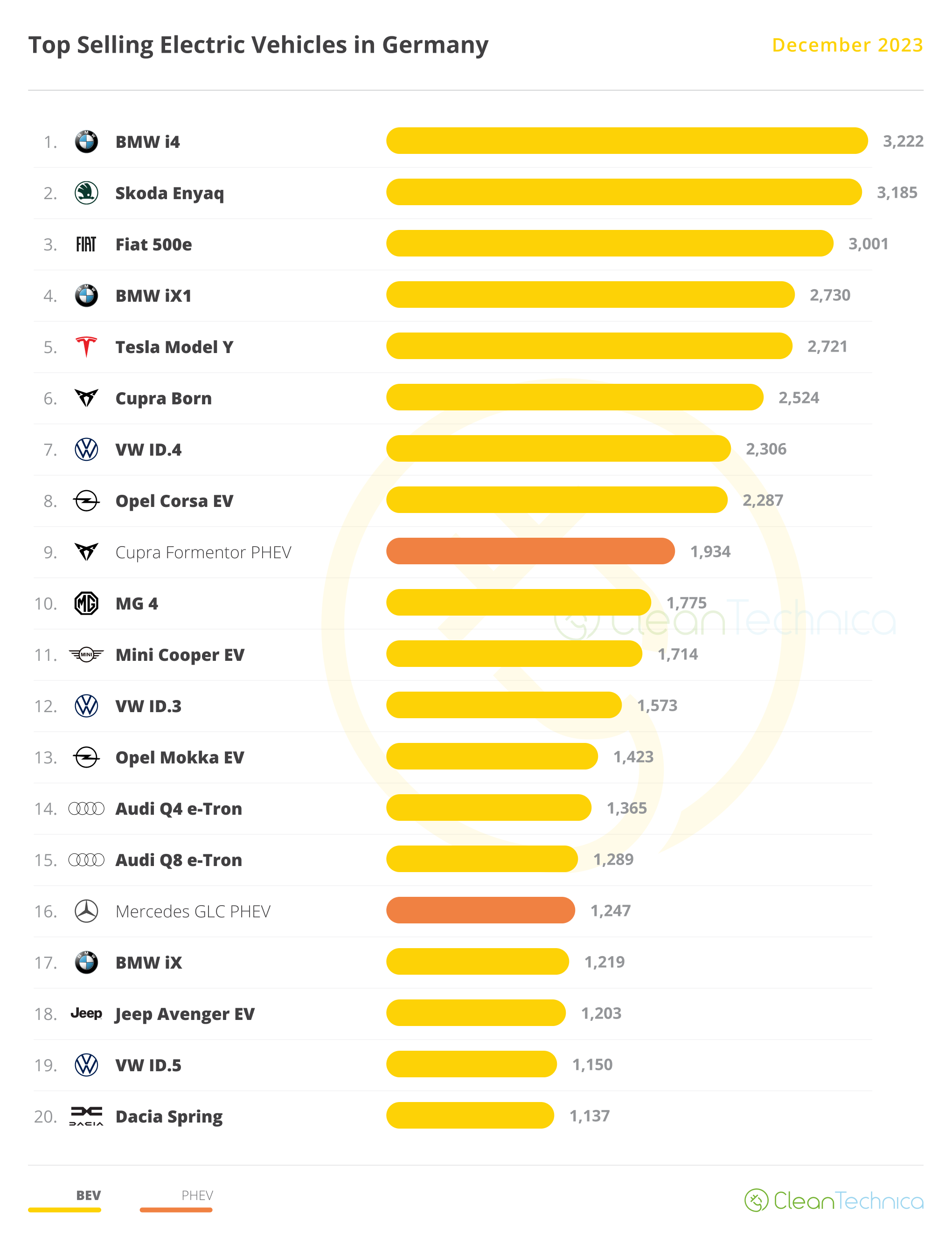

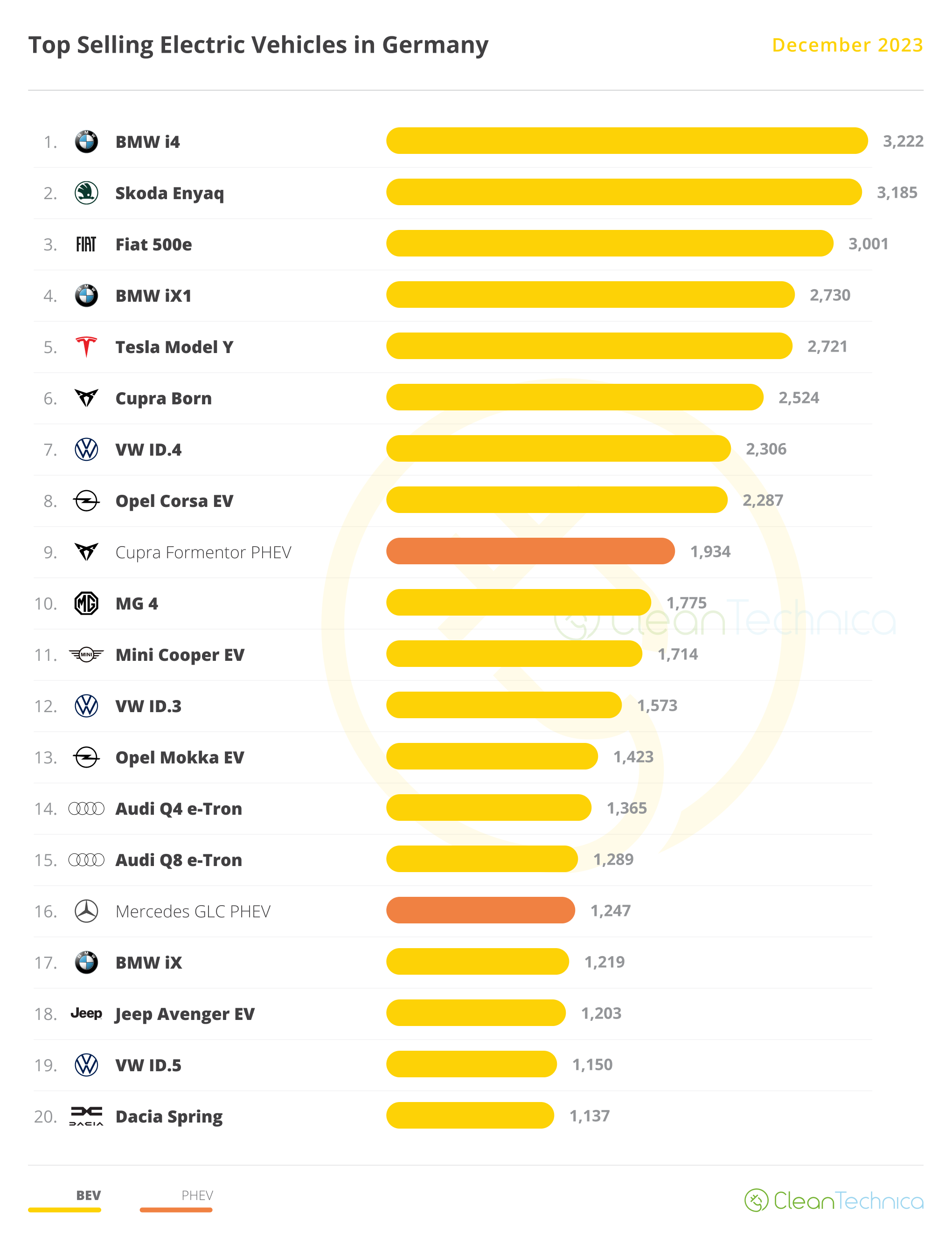

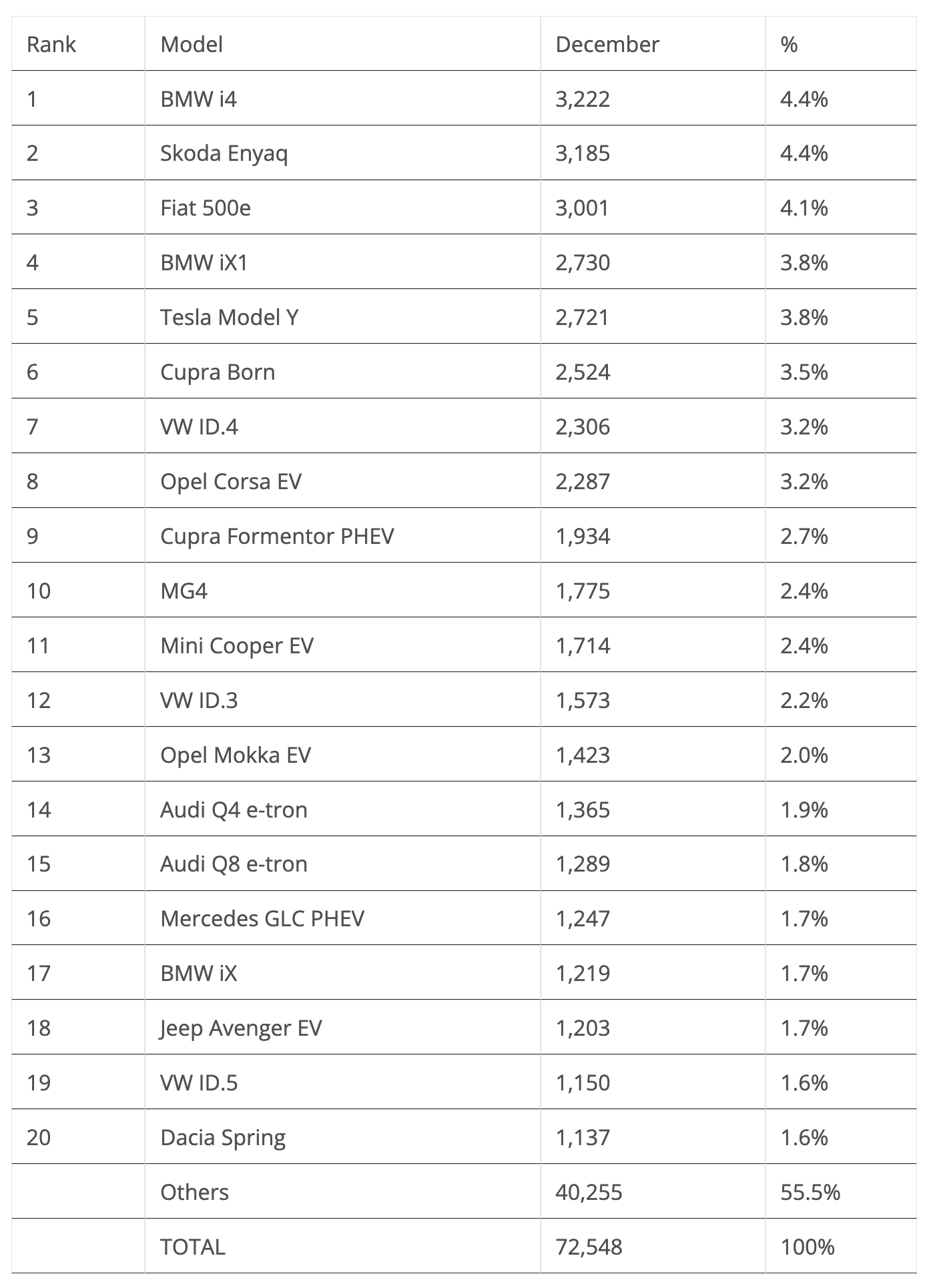

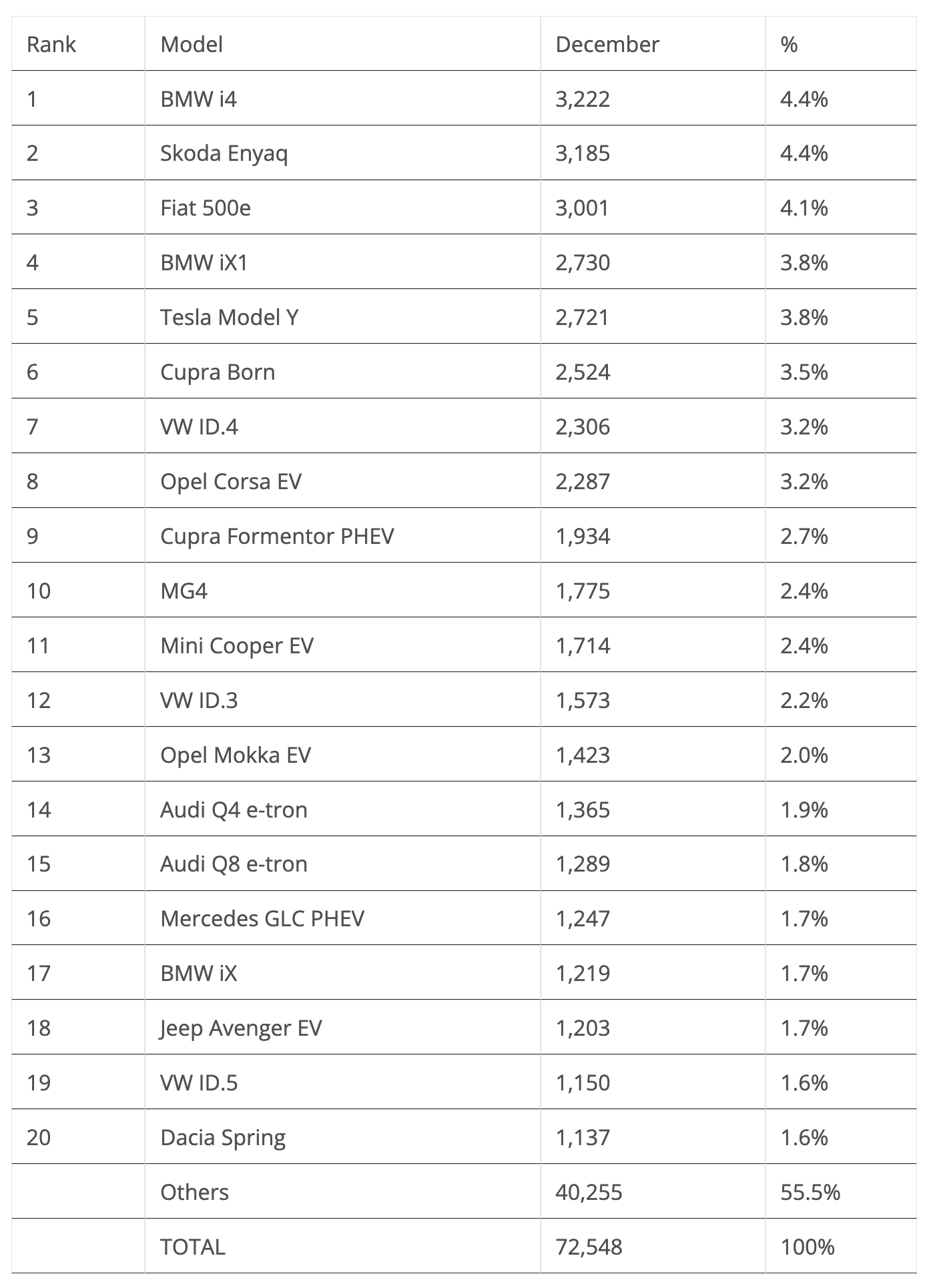

Looking at last month’s best sellers, first we should disclose that December registrations are not very representative of general market dynamics, because of the chaotic subsidy cut. As such, the results have much to do with the OEMs’ willingness to absorb the subsidy cut or not.

The German EV market surprised in December. The record 3,222 registrations of the BMW i4 in December allowed it to be the leader in the plugin market, almost tripling the sales of its nemesis, the Tesla Model 3 (1,131 registrations). For its part, the Model 3 had a horrible end of quarter, even ending outside the top 20! Of course, the end of the subsidy run in neighboring France might have had something to do with this….

The Skoda Enyaq and Fiat 500e rounded out the podium, in 2nd and 3rd respectively. In 4th, we have yet another surprise coming from BMW, with its other star player, the iX1 crossover, once gain beating its personal record, this time by scoring 2,730 registrations. That highlights the great month for the German make. The giant squirrel big iX joined the table in #17, thanks to 1,219 registrations, the SUV’s best score in 2023. Heck, even the compliance iX3 scored 704 registrations in December.

On the other hand, Tesla’s Model Y crossover had a weak end of quarter, ending just 5th in December, with 2,721 registrations. While the Model 3’s slow month might be easily explainable (see France’s article), the somewhat disappointing month for the crossover is harder to explain. And it probably helps to explain why Tesla decided to drop the prices of the Model Y, but not of the Model 3, in the beginning of 2024. Is the Osborne effect of the upcoming Model Y Juniper already kicking in?

Interesting to see is the fact that both the VW ID.4 and ID.3 were beaten by their foreign cousins, with the #7 VW ID.4 being beaten by the Czech #3 Skoda Enyaq and the #12 VW ID.3 being beaten by the Spaniard #6 Cupra Born. Coincidence?…

Elsewhere in the Volkswagen Group mothership, the Spanish Cupra brand placed a second model in the top 20, with the crossover Formentor PHEV ending the month in #9 thanks to a year best 1,934 registrations. In Audi HQ, it was a bitter sweet mood, because while on the one hand, the big fat Q8 e-tron scored 1,289 registrations (the large SUV’s best result since it added the “Q8” moniker to the name), the brand’s current bread and butter model, the Q4 e-tron, only scored 1,365 registrations, ending the month in #14, just one position ahead of the Q8 e-tron.

In other news, the trendy Opel Mokka EV crossover scored high in December, with 1,423 registrations. Added to the 2,287 registrations of the #8 Opel Corsa EV, that meant that Opel had a positive month and is apparently immune to the battery supply issues that some Stellantis brands (we are looking at you, Peugeot) are currently suffering. Still on the Stellantis stable, a mention is due for the 18th position of the Jeep Avenger EV, with the chunky & funky small crossover registering 1,203 units.

Outside this top 20, a few models deserve some attention, like the BYD Atto 3 (euro-spec Yuan Plus) registering 555 units, the new generation Hyundai Kona EV ramping up deliveries to an already relevant 942 units (expect the Korean crossover to start showing up on the table soon), the Mercedes EQE sedan getting 670 registrations, and the old-timer VW e-Up scoring a meritable 565 units in December — not bad for a model that landed in late 2011!

Speaking of old timers, the 11-year-old Renault Zoe had its best score of the year in December, 572 registrations, almost beating the best selling Renault in the table, the also veteran Renault Twingo EV (593 registrations). This is all while the much younger Renault Megane EV registered just 327 units in the same period. Yep, Renault’s current EV lineup is looking like US politics in 2024: two old geezers calling the shots, all while the young ones are waiting for them to go away.

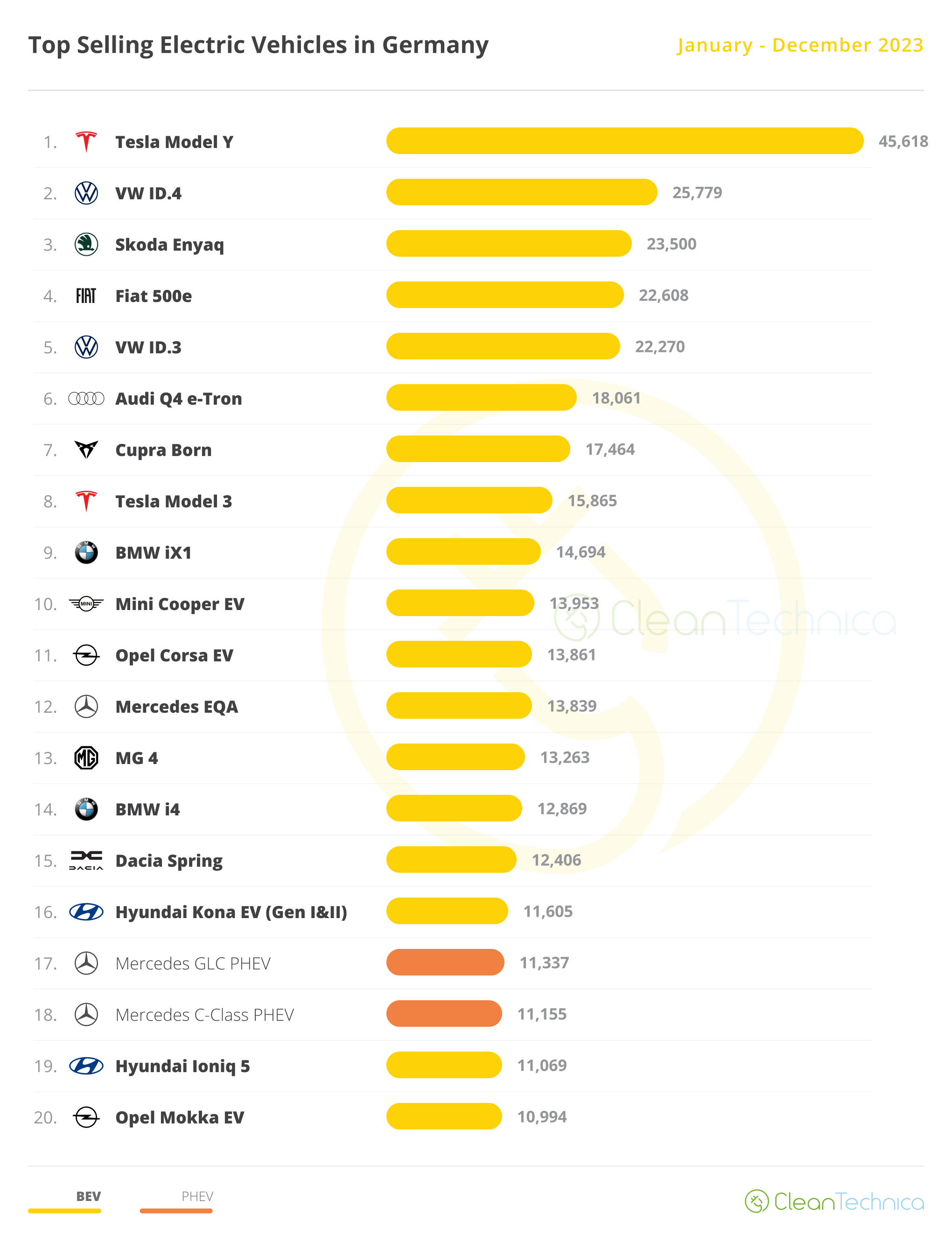

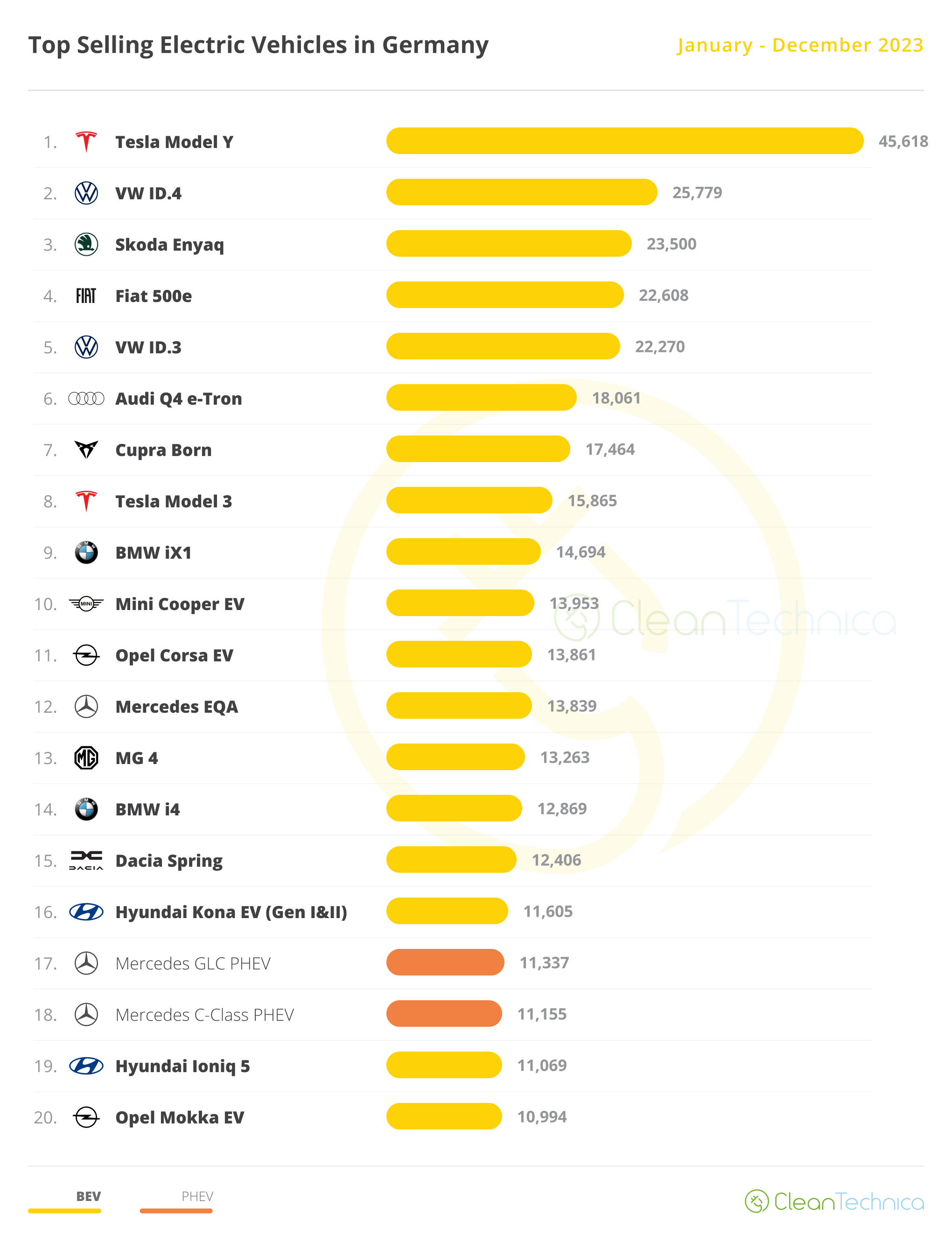

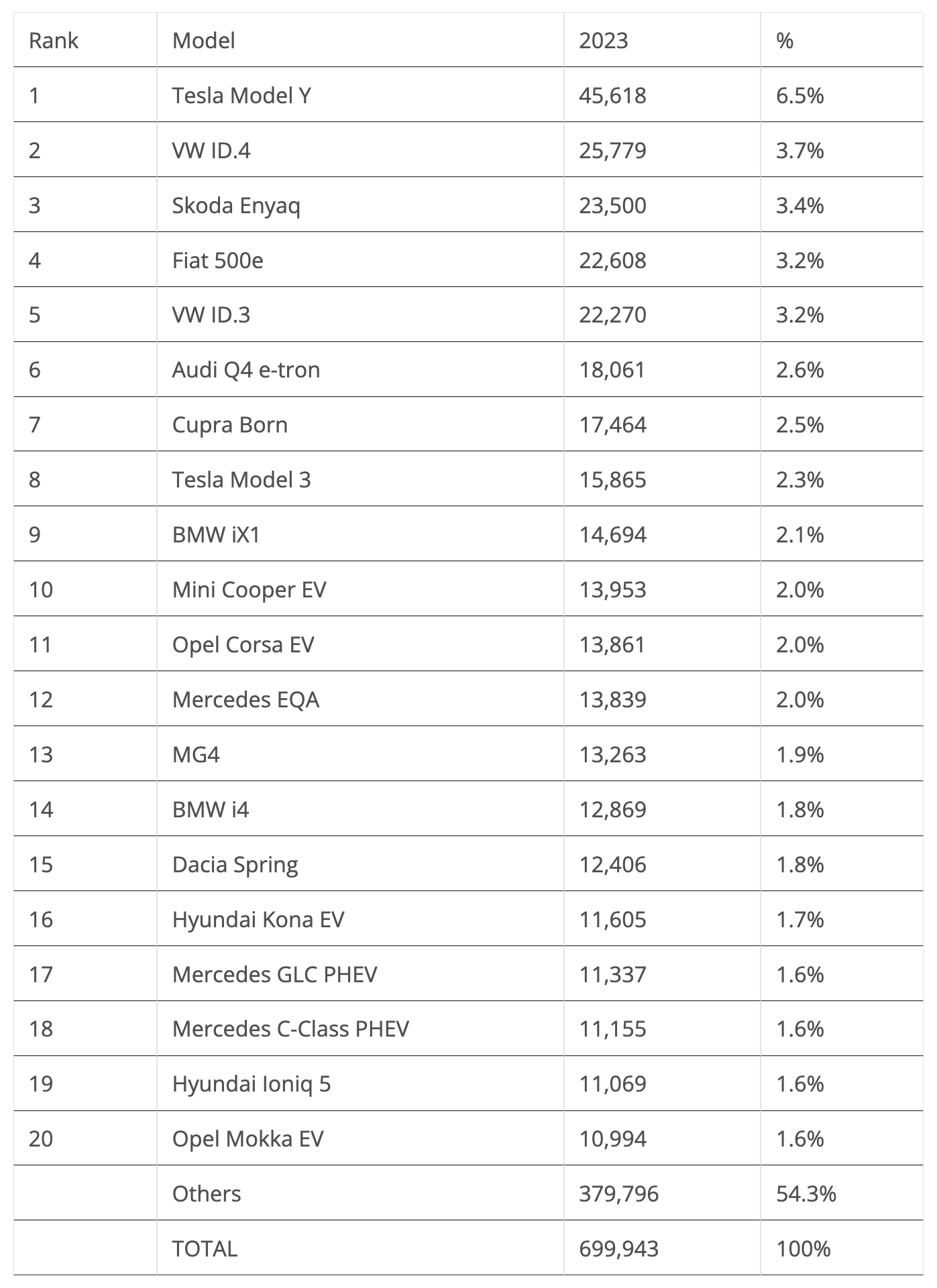

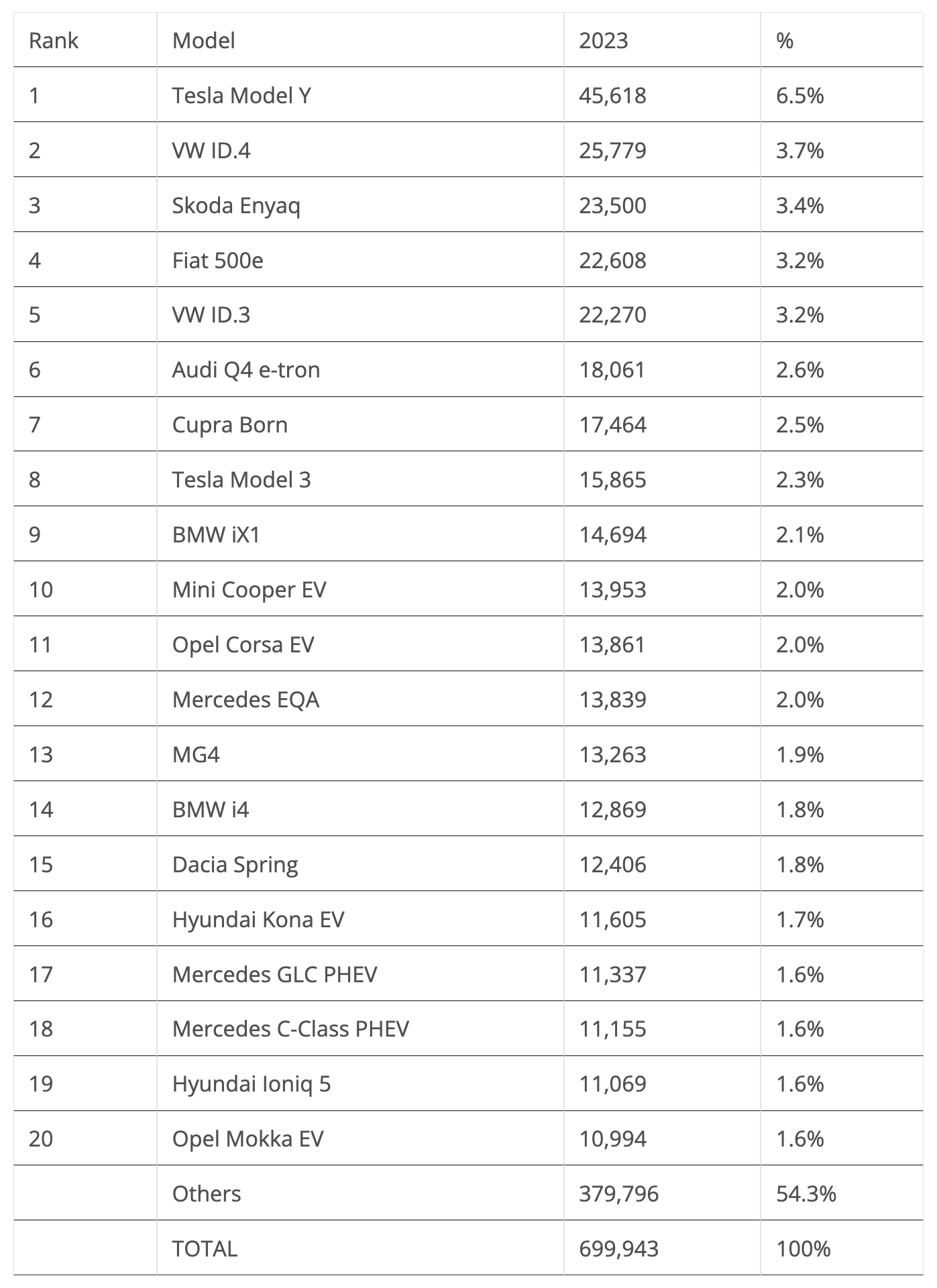

Regarding the final 2023 table, and looking at the podium positions, this year’s winner was the Tesla Model Y, with the crossover repeating the previous year’s title win.

The VW ID.4 finally started to fulfill expectations this year, ending the year in the runner-up spot, only behind the all-mighty Tesla Model Y. That was the German crossover’s first podium presence, and the first silver medal for a MEB-based model, improving on the 3rd position achieved by the VW ID.3 in 2021.

Interestingly, Volkswagen has never won its domestic best selling model award….

In 3rd, we have another MEB-based model, the VW ID.3 Skoda Enyaq, allowing the Czech make to experience its first podium presence in Germany. That was thanks to a strong month in December from the Skoda EV as well as a slow month from the VW hatchback, which allowed the Enyaq to climb into 3rd in the last stage of the race.

Interestingly, for the first time ever, all podium positions went to crossovers, which says a lot about the direction the automotive market is going in.

Will 2024 bring new surprises to the podium positions? Expect the Tesla Model Y to remain there, most likely in #1. As for the remaining positions … everything is open for discussion. Volkswagen will try to pull both the ID.3 and ID.4 onto the podium, but that is far from a sure thing, especially considering their recent demand issues. On the other hand, the Skoda Enyaq will stay a strong contender, like the Fiat 500e. BMWs i4 and iX1 should be also strong candidates, but knowing how surprising the German EV market is, some dark horse might come out of nowhere and steal the show.

Off the podium, there were some last-minute changes. Benefitting from the aforementioned slow month from the VW ID.3, the Fiat 500e went up one position in December, to 4th. Opel had a strong December, pulling the Corsa EV to #11 and adding the Mokka EV to the table at #20.

Speaking of new entries, thanks to a record month in December, the BMW i4 stormed through the table, joining it in #14. Meanwhile, the smaller BMW iX1 also climbed higher, in this case from #11 to #9, ending 2023 in the top half of the table.

An interesting consequence of the BMW midsize EV ending the year in #14, with some 13,000 registrations, is that it ended some 3,000 units behind its rival, the #8 Tesla Model 3, which was down a significant 52% in 2023. We might see an entertaining race between these two in 2024.

Sure, the recent Model 3 refresh will probably help it to revive sales, but do not expect Tesla’s sedan to return to anywhere near the German podium anytime soon. The 4-time podium bearer (3rd in 2019 and 2020, 1st in 2021, 2nd in 2022) is now a clear second choice behind the Made-in-Germany Model Y. And with the BMW i4 on the rise, the Tesla midsizer will have its work cut out for it if it wants to keep the BMW rival behind it.

The last position change to mention was the Mercedes GLC PHEV climbing to #17 and becoming 2023’s best selling PHEV, recovering the title from the Ford Kuga PHEV (the Mercedes GLC PHEV also had the title in 2021). Expect the PHEV category to continue losing relevance in 2024, with possibly only one representative on the table. Unless something unexpected happens, expect the Mercedes GLC to keep this category title in 2024, as it seems that Mercedes is the only brand now selling PHEVs in large volumes in the German market (it helps that many of their PHEV models have usable range).

Looking at size categories, the #4 Fiat 500e again won the city car category, but it saw its sales dip by 21% year over year (YoY). The #15 Dacia Spring was a distant second, while the Smart Fortwo EV rounded out the category podium. Expect the little Italian to consolidate its leadership position in 2024, as no major disruptions are expected in this segment.

In the category above, the #10 Mini Cooper EV won the B-segment title, but the Opel Corsa EV was a close second, ending fewer than 100 units behind the Brit. Interestingly, something similar had already happened to the Opel EV in 2022. At that time, it remained behind the #16 Hyundai Kona EV, now 3rd in the category. Better luck in 2024?

The VW ID.4 won the compact category title for the first time, followed by the Skoda Enyaq in #2 and the VW ID.3 in #3. This created the first 100% MEB-based podium. In fact, all top five positions in the category belong to Volkswagen Group and are based on the MEB platform — #4 is the Audi Q4 e-tron and #5 is the Cupra Born. The German OEM might not achieve the same feat in 2024, though, as the BMW iX1 and MG4 seem strong enough to run at the same pace as them.

In the midsize category, it was the usual #1 plus #2 win for Tesla, with the BMW i4 in 3rd. But as mentioned earlier, this could be the last time that Tesla manages to do that, as apparently the Model 3 now has a competitor worthy of the name.

As for the full size category, as always, the Audi Q8 e-tron reigns supreme, with around 10,000 units registered. It is followed at a distance by the Mercedes EQE (6,700 registrations), but considering the most recent performances, the BMW iX (and also the i5?) could give both a run for their money in 2024.

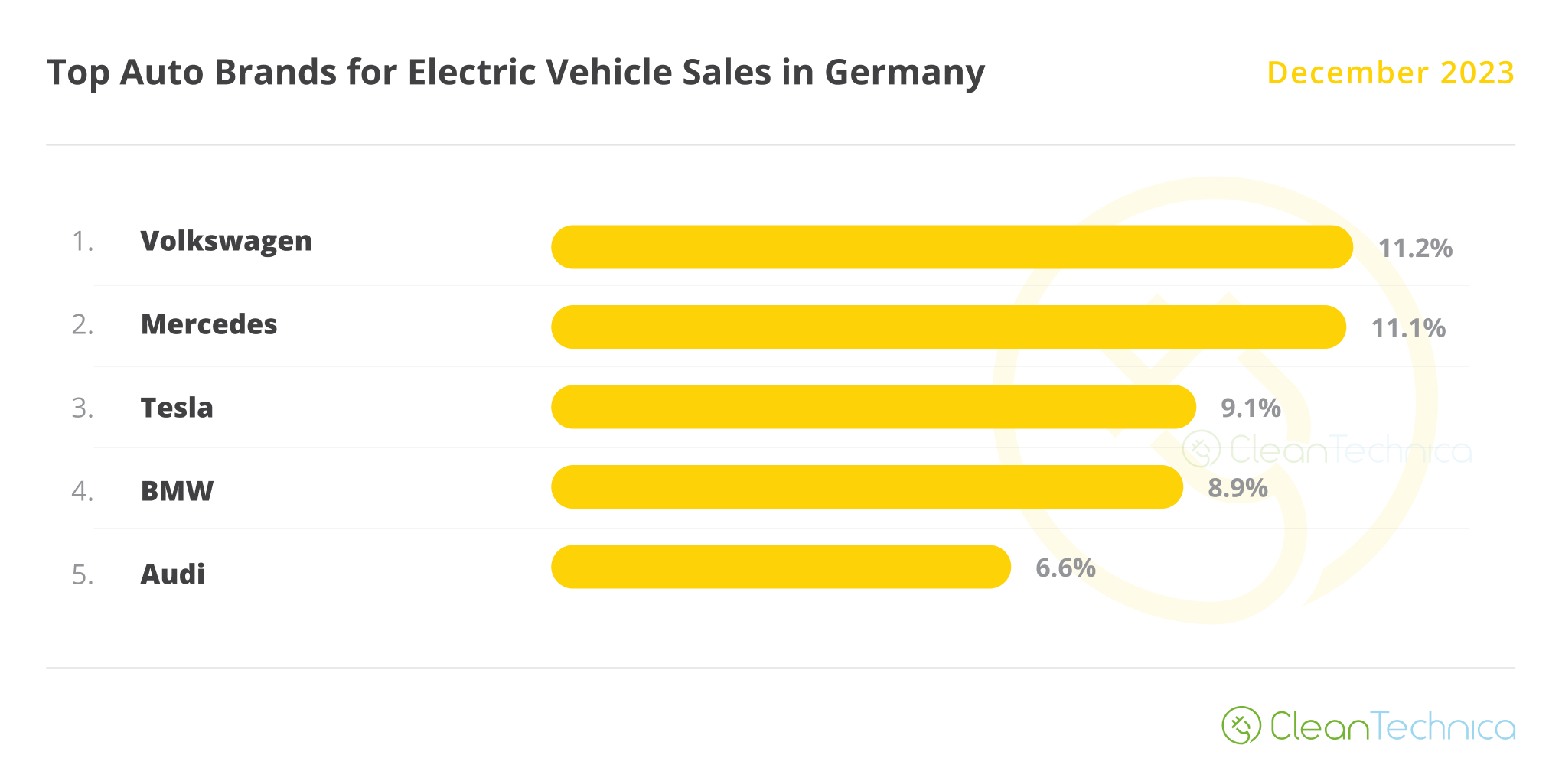

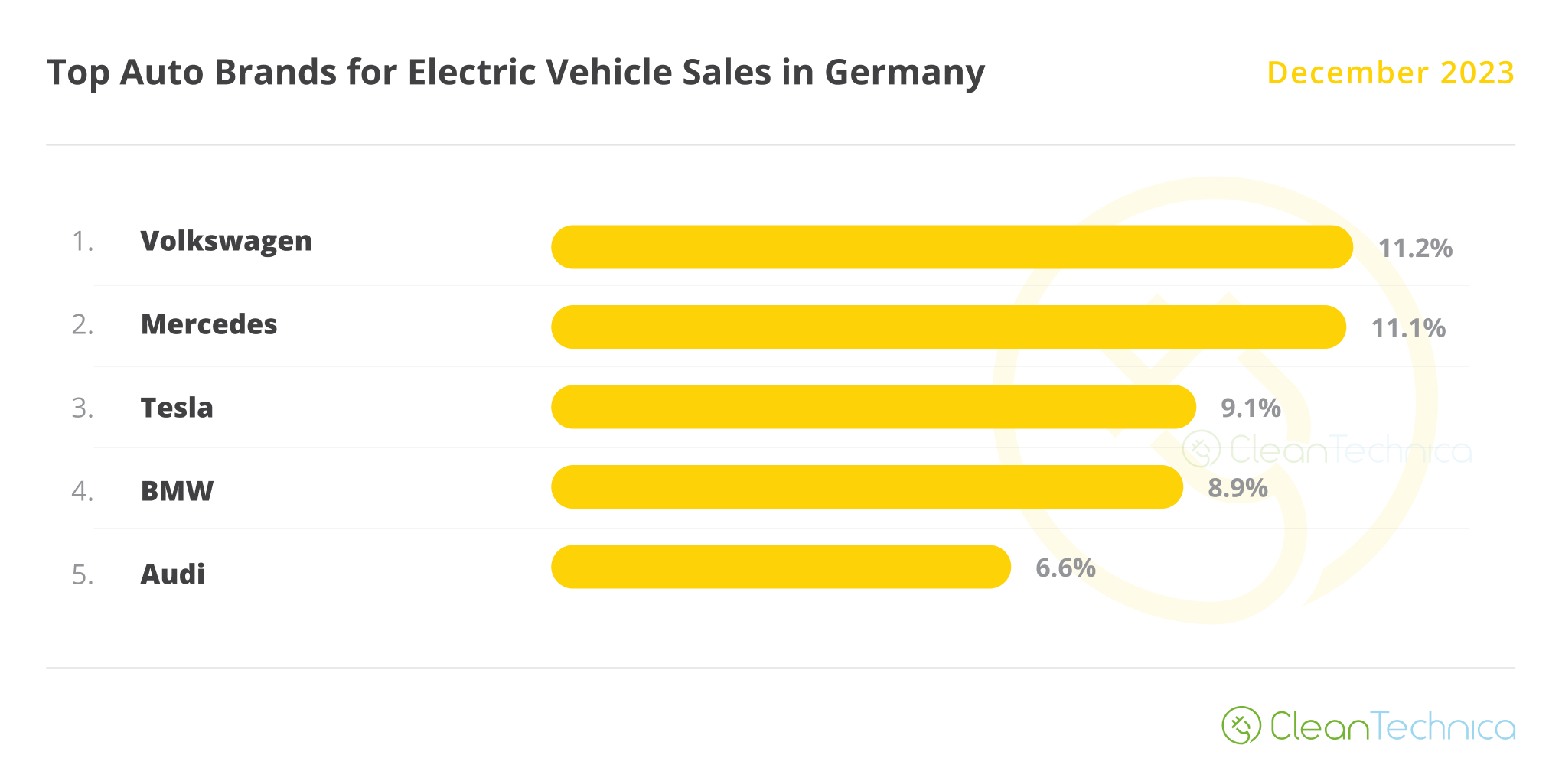

Top Auto Brands for Electric Vehicle Sales in Germany — 2022

In the brand ranking, the leadership had a last-minute change, with Volkswagen (11.2%) surpassing Mercedes (11.1%, down 0.3%) in December and winning its 4th straight title, relegating Mercedes to the runner-up spot. So, the three-pointed-star make collected its 4th silver medal in a row, and yet, it was so close to gold this time….

Tesla (9.1%, down from 9.5%) held onto the 3rd spot, but rising #4 BMW (8.9%, up from 8.3%) could have snatched the 2023 bronze medal if there was a 13th stage to the race.

Interestingly, the 2023 podium is exactly the same as the 2022 one. Will it be the same in 2024?

Audi (6.6%%, down from 6.7%) ended in 5th, with the German brand ending the race with a comfortable advantage over #6 Opel (4.9%, up 0.1%), which surpassed Hyundai (4.8%, down 0.1%) in December.

How will things play out in 2024? While the top three brands do not have any major new models to speak of, the same cannot be said of Audi, which will introduce a new A6 e-tron and, above all, the new Q6 e-tron midsize SUV. Both are coming from the new PPE platform. Depending on market demand, and most importantly, on how fast the production ramp-up goes (the PPE platform has experienced successive delays…), Audi could have enough arguments in 2024 to finally try and reach a podium position, something that the Ingolstadt brand has been missing since 2020 (it was 3rd then).

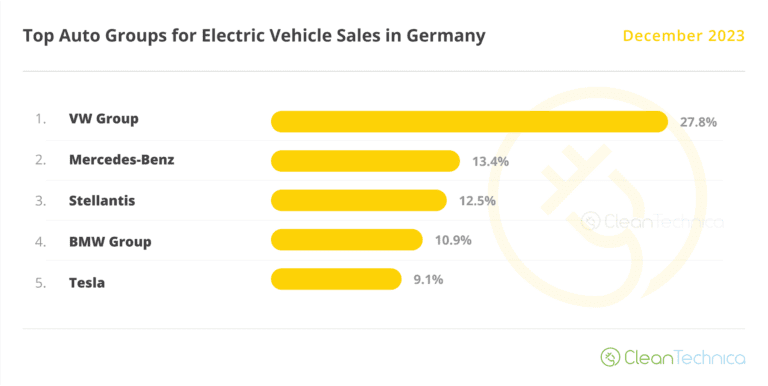

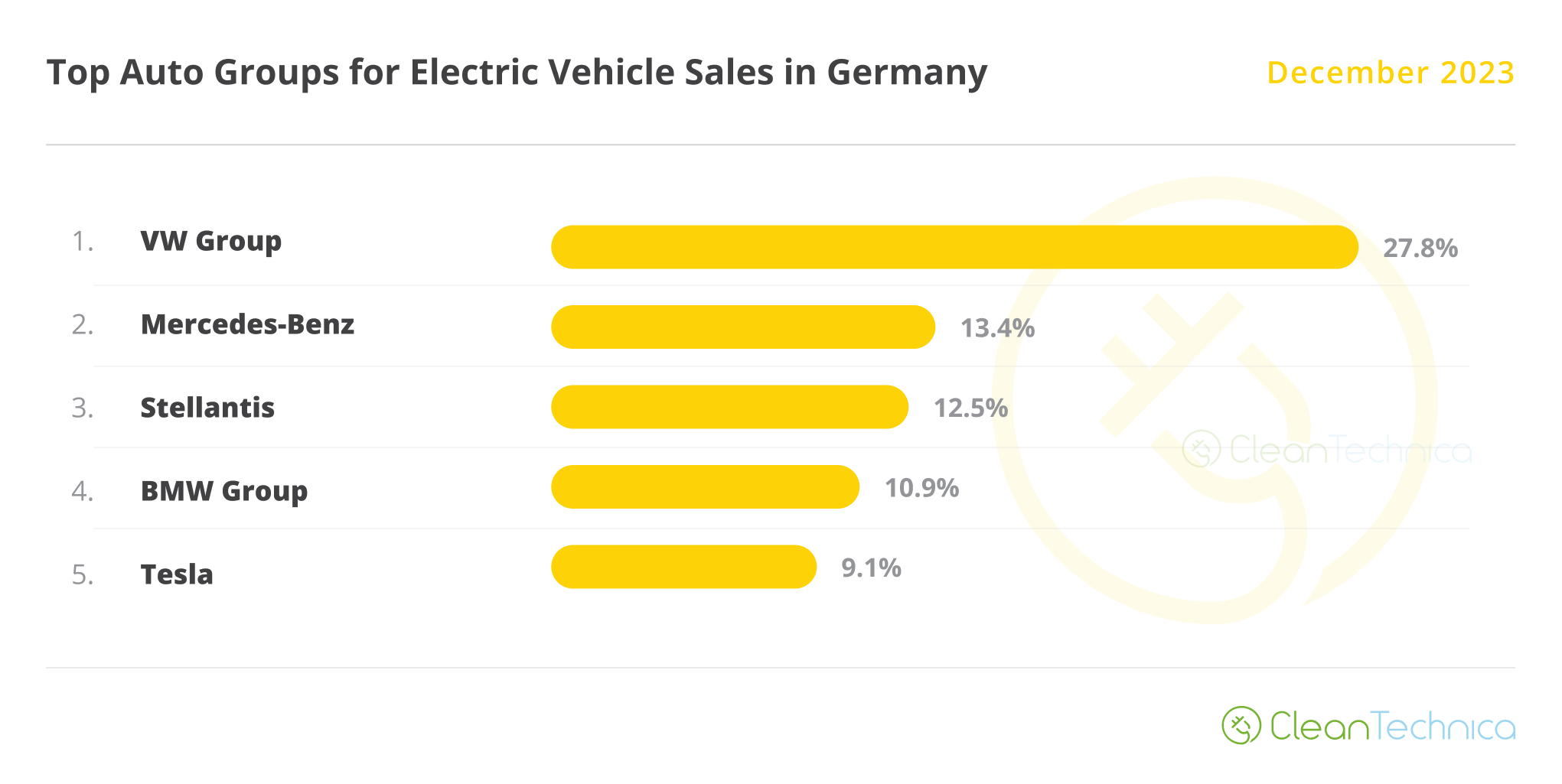

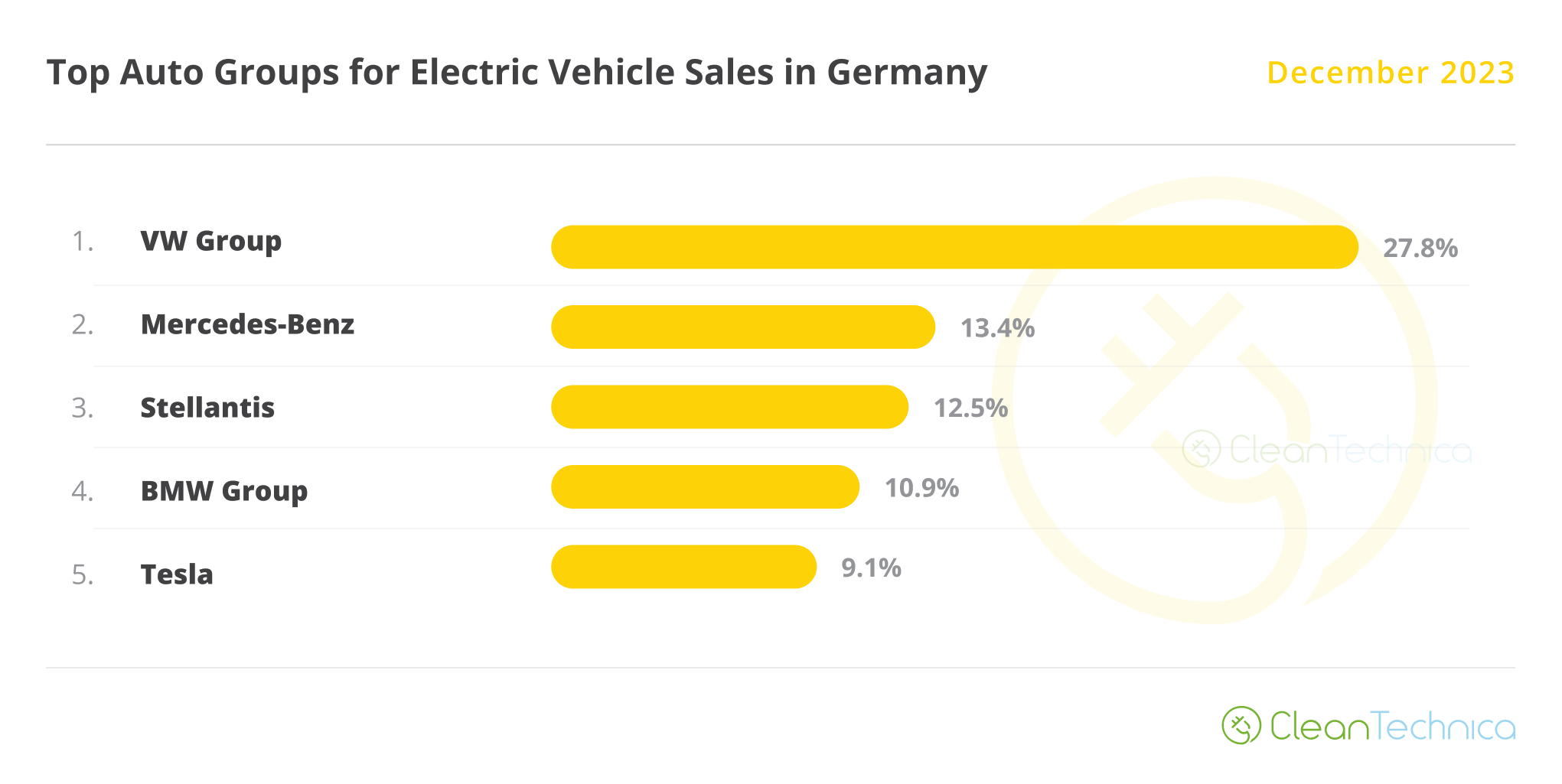

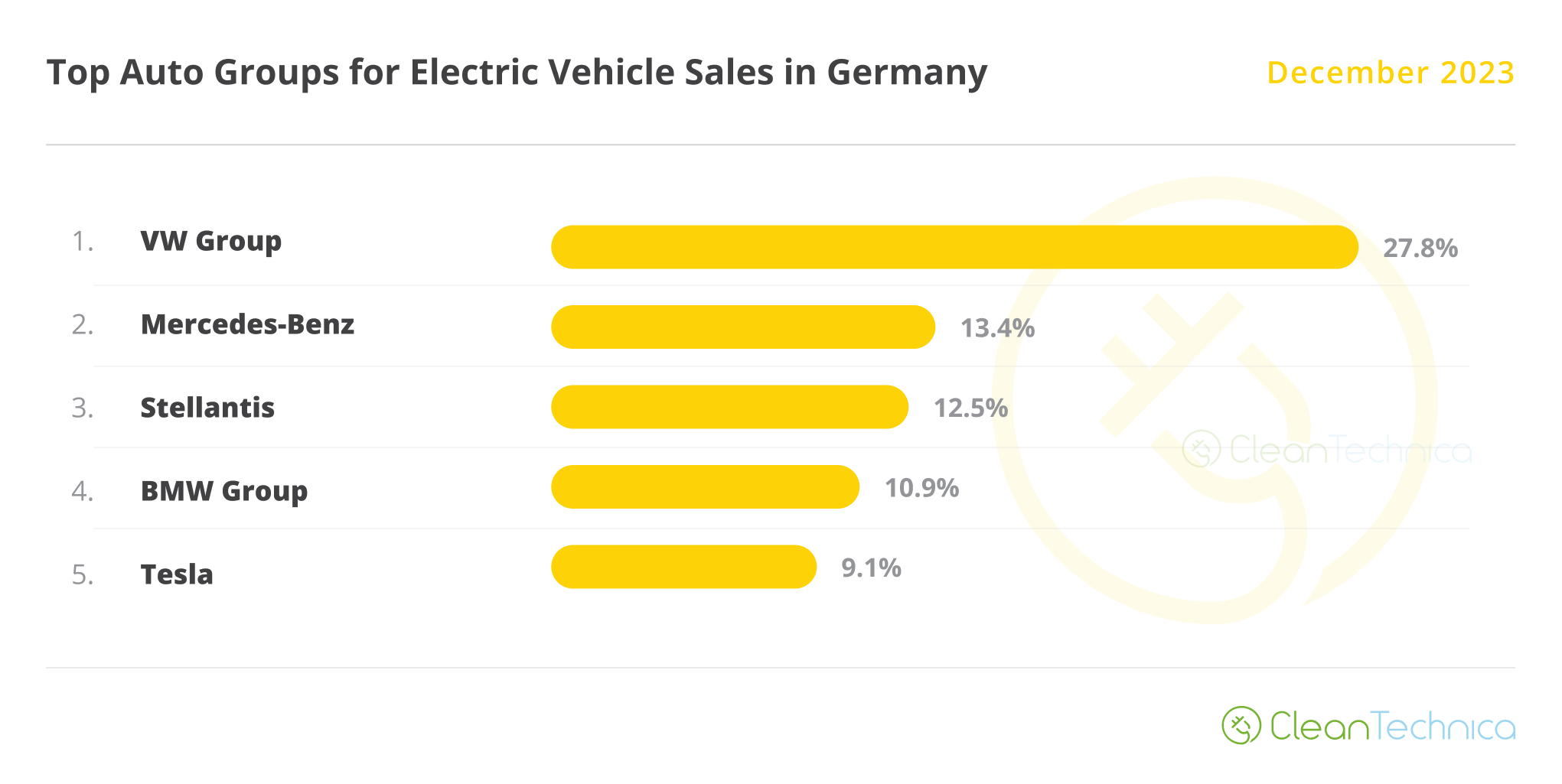

As for OEMs, Volkswagen Group (27.8%) won again by a landslide. Mercedes-Benz (13.4, down 0.4%) remained in 2nd, ahead of Stellantis (12.5%, up 0.2%), with these last two OEMs switching places compared to 2022.

BMW Group (10.9%, up 0.6%) was 4th, repeating last year’s result, and #5 Tesla (9.1%) was up one spot compared with 2022, switching places with #6 Hyundai–Kia (8%, down 0.1%).

Do not expect major changes in this top 5, but Mercedes-Benz, Stellantis and the BMW Group could be switching places amongst themselves.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Like other media companies, we need reader support! If you support us, please chip in a bit monthly to help our team write, edit, and publish 15 cleantech stories a day!

Thank you!

CleanTechnica uses affiliate links. See our policy here.