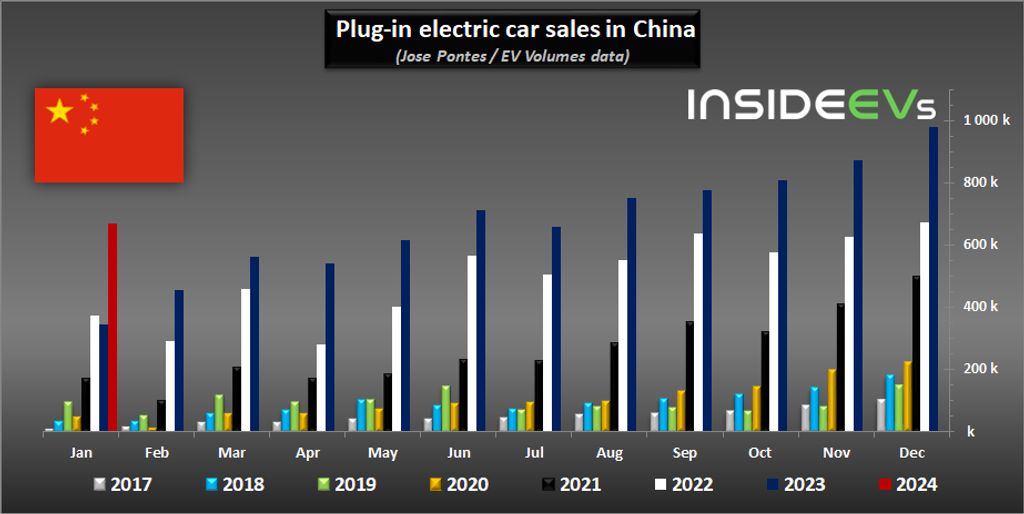

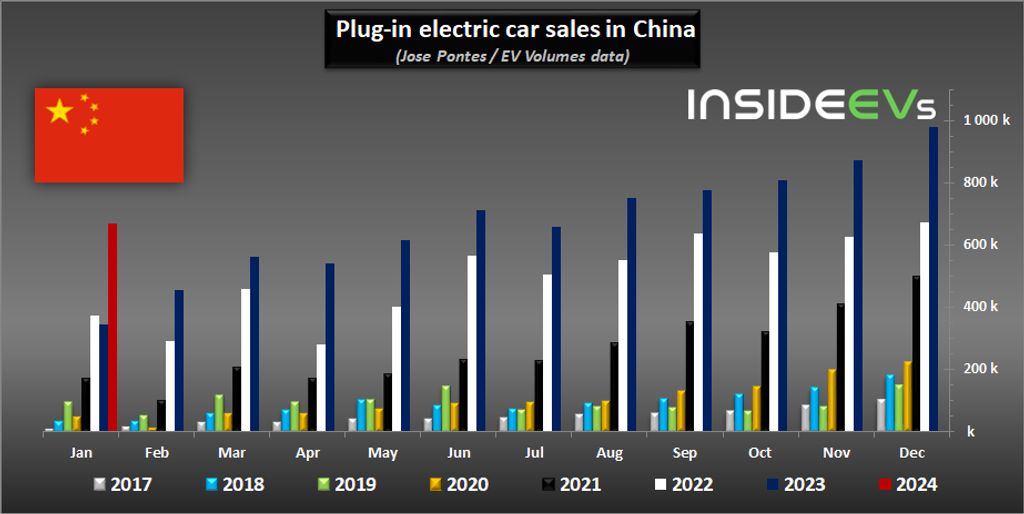

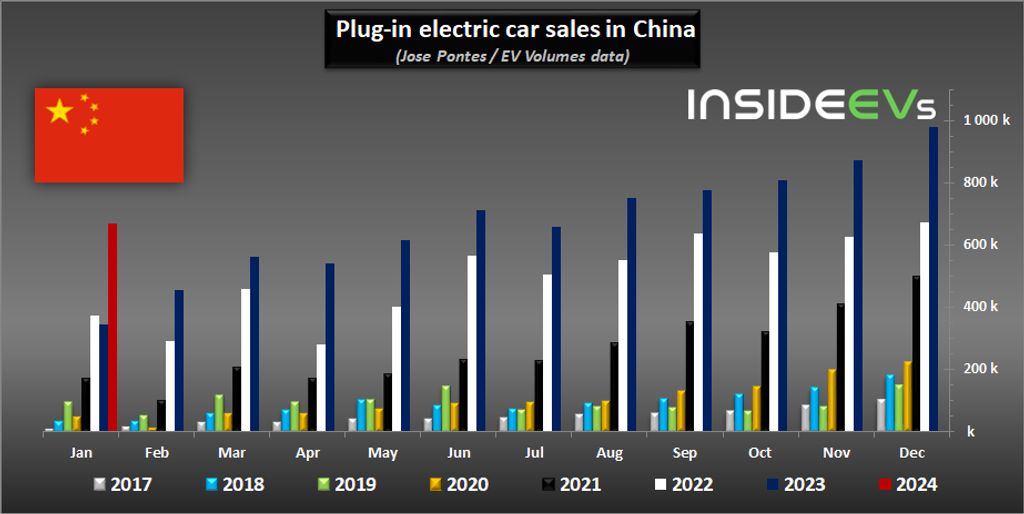

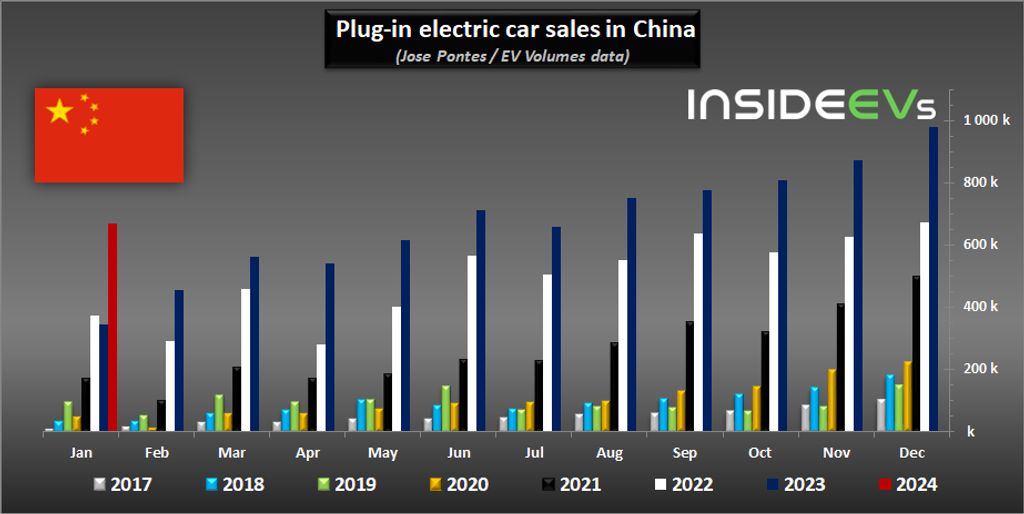

China Plug-In Car Sales Almost Doubled In January 2024

Plug-in electric car sales noted a very strong start of the year in China. The volume almost doubled year-over-year to a level exceeding expectations.

According to EV Volumes’ data, shared by researcher Jose Pontes, 668,000 new passenger plug-in electric cars were registered in China in January, roughly 94% more than a year ago. That’s about 32% of all new car registrations.

Get Fully Charged

Plug-in car sales surges in China

The Chinese plug-in electric car market is not only the largest one in the world but it also represents the majority of global plug-in car sales. The share of rechargeable cars in China in 2023 amounted to 37% (compared to 30% in 2022).

All-electric car registrations amounted to 56% of the total plug-in car registrations, which is about 374,000 (up 55% year-over-year). That’s about 18% of the market.

It means that plug-in hybrids are the ones that contributed the most to the outstanding growth. PHEV registrations amounted to about 294,000 (up nearly 150% year-over-year, we estimate). This number includes the EREV series hybrids with plug-in capability, which are becoming popular in China.

Plug-in car registrations for the month (YOY change):

- BEVs: about *374,000 (up 55%) and 18% market share

- PHEVs: about *294,000 and 14% market share

- Total: 668,000 (up 94%) and 32% market share

* estimated

For reference, in 2023, more than 8 million new plug-in electric cars were registered in China (up roughly 46% year-over-year). That’s about 37% of the total volume (compared to 30% in 2022, 15% in 2021 and 6.3% in 2020).

Plug-in car registrations in 2023 (YOY change):

- BEVs: about *5.34 million and 25% market share

- PHEVs: about *2.75 million and 12% market share

- Total: 8,095,078 (up 37%) and 37% market share

* estimated from the market share

Considering the strong start of the year, 2024 should be even better, most likely above 10 million units.

The BYD Song family remains the best-selling plug-in electric car in China. In January, it noted 52,219 registrations (mostly PHEVs).

The second most popular nameplate was the Aito M7 (from the Huawei and Seres’ joint venture), an EREV SUV, which attracted almost 30,000 customers last month. The Tesla Model Y was third best among plug-ins, maintaining its top position among all-electric cars (29,912).

Top 10 plug-ins in January:

- BYD Song Plus: 52,219 (6,562 BEVs + 45,657 PHEVs)

- Aito M7 (EREV): 29,997

- Tesla Model Y: 29,912

- BYD Qin Plus: 29,244 (4,613 BEVs + 24,631 PHEVs)

- BYD Seagull: 28,050

- BYD Yuan Plus (aka Atto 3): 16,831

- BYD Dolphin: 16,386

- Changan Lumin: 16,041

- Wuling Hong Guang MINI EV: 15,520

- Li Xiang L7: 13,343

Below, we attached numbers for 2023.

Top 10 plug-ins in January-December 2023:

- BYD Song Plus: 627,731 (92,983 BEVs + 534,748 PHEVs)

- Tesla Model Y: 456,394

- BYD Qin Plus: 434,910 (123,170 BEVs + 311,740 PHEVs)

- BYD Yuan Plus (aka Atto 3): 338,490

- BYD Dolphin: 334,800

- BYD Seagull: 253,664

- Wuling Hong Guang MINI EV: 237,878

- GAC Aion Y: 235,717

- BYD Han: 227,705 (106,904 BEVs + 120,801 PHEVs)

- GAC Aion S: 220,904

* BEV and PHEV versions of the same models were counted together in the source.

BYD dominates the Chinese plug-in market with a huge 28.5% share in the plug-in car segment (31% when including its satellite brands), and this is not expected to change in the near term.

Top brands by share in the plug-in segment in January:

- BYD: 28.5%

- Geely: 6.2%

- Tesla: 6.0%

- SAIC-GM-Wuling: 5.9%

- Li Auto: 4.7%

- Aito: 4.6%

- Changan: 4.5%

Top automotive groups by share in the plug-in segment in January:

- BYD: 31%

including Denza, Fang Cheng Bao and Yangwang brands - Geely-Volvo: 9.6%

- Changan: 7.7%

- SAIC: 6.2%

including the SAIC-GM-Wuling joint venture (between SAIC, GM, and Liuzhou Wuling Motors) - Tesla: 6.0%

- GAC: 5.1%