Egypt’s tourism revenues break record with $15bn in 2023: El Batouty – Dailynewsegypt

Egypt’s tourism revenues reached a record high of $15bn in 2023, surpassing the previous records of $12.5bn in 2010 and $13bn in 2019, before the January Revolution and the COVID-19 pandemic, respectively. This was revealed by Said El Batouty, Professor of International Macroeconomics and Tourism Economics at Goethe University in Frankfurt, Germany, and Member of the Advisory Group of the European Commission, United Nations Economic Commission for Europe (UNECE), and the European Travel Commission (ETC), in an interview with Daily News Egypt.

He also said that Egypt welcomed a record number of 14.9 million international tourists in 2023, exceeding the peak year of 2010 (14.7 million) and the pre-pandemic year of 2019 (12.9 million).

El Batouty attributed this remarkable achievement to the effective measures taken by the Egyptian government to ensure the safety and health of tourists, as well as the promotion of the country’s rich cultural and natural heritage.

International tourism on track to recover by 2024

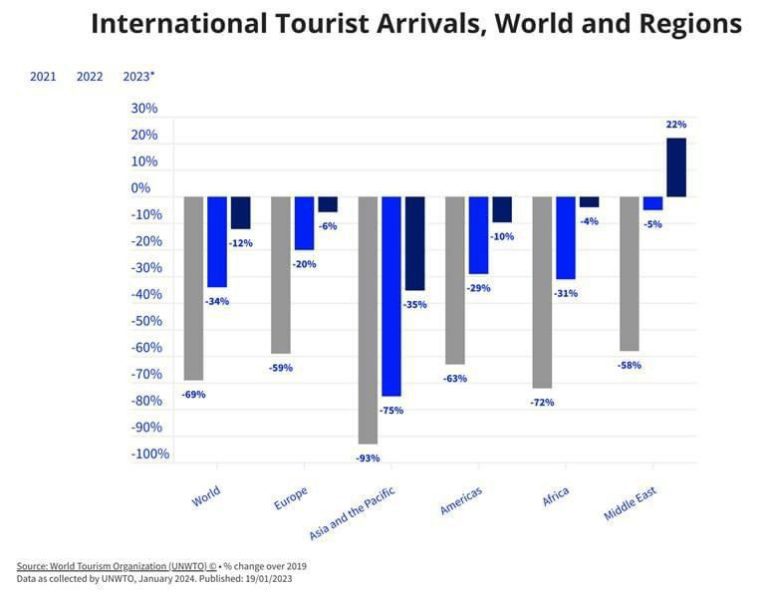

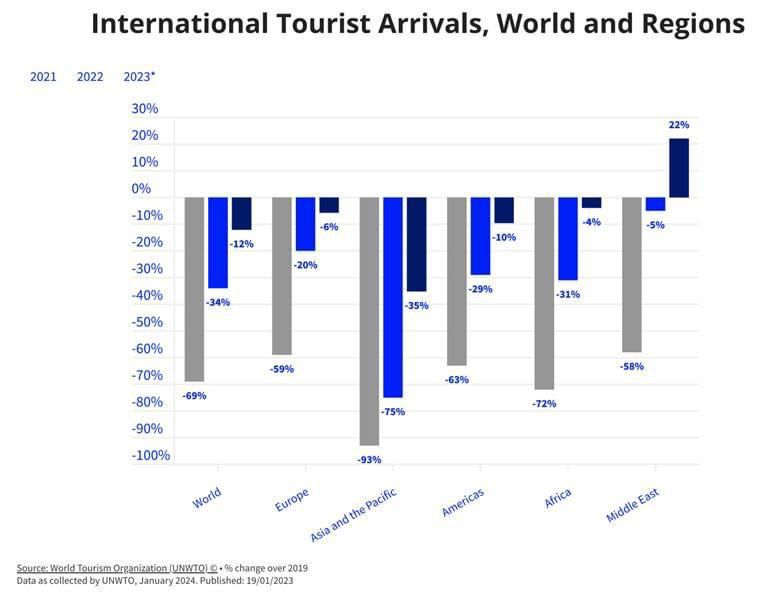

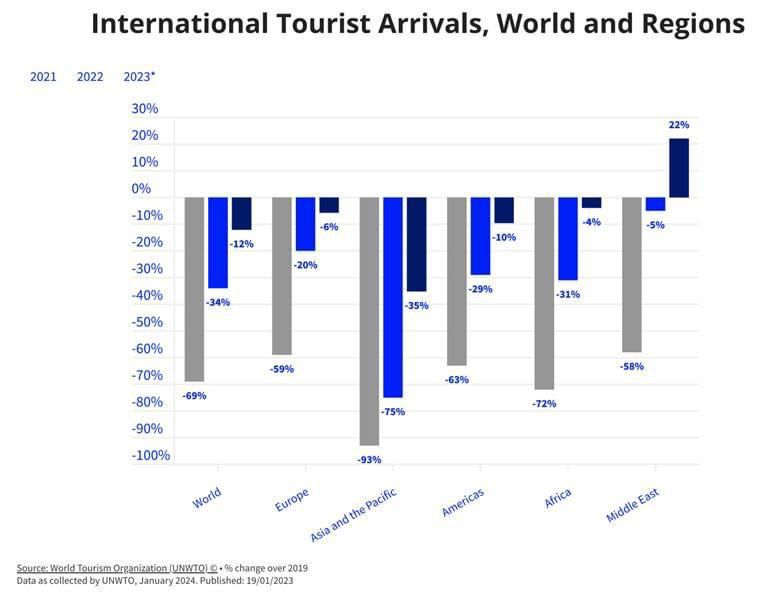

Following a strong performance in 2023, international tourism is expected to return to pre-pandemic levels by the end of 2024, according to the first UNWTO World Tourism Barometer of the year. International tourism ended 2023 at 88% of 2019 levels, with an estimated 1.3 billion international arrivals. The factors that will support the full recovery include the release of pent-up demand, increased air connectivity, and a stronger rebound of Asian markets and destinations.

The latest UNWTO World Tourism Barometer provides a detailed analysis of the sector’s performance in 2023, tracking recovery by global region, sub-region, and destination. Some of the key findings are:

• The Middle East was the only region to surpass pre-pandemic levels, with arrivals 22% higher than in 2019.

• Europe, the most visited region in the world, reached 94% of 2019 levels, boosted by intra-regional travel and visitors from the United States.

• Africa and the Americas recovered 96% and 90% of pre-pandemic visitors, respectively.

• Asia and the Pacific reached 65% of pre-pandemic levels, with a mixed performance across sub-regions. South Asia recovered 87% of 2019 levels, while North-East Asia reached only 55%.

The data also shows that several destinations, both large and small, experienced double-digit growth in international arrivals in 2023 compared to 2019. Four sub-regions exceeded their 2019 arrival levels: Southern Mediterranean Europe, the Caribbean, Central America, and North Africa.

UNWTO Secretary-General Zurab Pololikashvili commented: “The latest UNWTO data confirms tourism’s resilience and rapid recovery, with pre-pandemic numbers expected by the end of 2024. The rebound is already having a positive impact on economies, jobs, growth, and opportunities for communities everywhere. These numbers also remind us of the critical task of advancing sustainability and inclusion in tourism development.”

International tourism generated $1.4trn in 2023

The latest UNWTO data also highlights the economic impact of tourism recovery. International tourism receipts reached $1.4trn in 2023, according to preliminary estimates, which is about 93% of the $1.5trn earned by destinations in 2019.

In addition, the total export revenues from tourism (including passenger transport) are estimated at $1.6trn in 2023, almost 95% of the $1.7trn recorded in 2019.

“Preliminary estimates on the economic contribution of tourism, measured in tourism direct gross domestic product (TDGDP), indicate $3.3trn in 2023, or 3% of global GDP. This suggests a recovery of pre-pandemic TDGDP driven by strong domestic and international tourism,” according to the UNWTO.

According to the UNWTO, several destinations witnessed strong growth in international tourism receipts during the first ten to twelve months of 2023, outpacing growth in arrivals in some cases. Strong demand for outbound travel was also evident from several large source markets during this period, with many surpassing 2019 levels.

The recovery was also reflected in the performance of industry indicators. The UNWTO Tourism Recovery Tracker showed that both international air capacity and passenger demand recovered about 90% of pre-pandemic levels by October 2023 (IATA). Global occupancy rates in accommodation establishments reached 65% in November, slightly higher than 62% in November 2022 (based on STR data).

Looking Ahead to 2024

The UNWTO expects that international tourism will fully recover pre-pandemic levels in 2024, with initial estimates indicating 2% growth above 2019 levels. This central forecast by the UNWTO is subject to the pace of recovery in Asia and the evolution of existing economic and geopolitical downside risks.

The latest UNWTO Tourism Confidence Index survey reveals an optimistic outlook for the tourism industry in 2024. The survey shows that 67% of tourism professionals expect better or much better prospects compared to 2023, while only 6% anticipate a decline in tourism performance. This positive sentiment is driven by several key factors.

There is still significant room for recovery across Asia, as multiple source markets and destinations reopen, boosting regional and global recovery efforts. Specifically, Chinese outbound and inbound tourism is expected to accelerate in 2024 due to visa facilitation and improved air capacity. China has implemented visa-free travel for citizens of France, Germany, Italy, the Netherlands, Spain, and Malaysia until November 2024.

Visa and travel facilitation measures are also set to promote travel to and within the Middle East and Africa. The Gulf Cooperation Council (GCC) countries plan to introduce a unified tourist visa, similar to the Schengen visa, while Kenya and Rwanda are implementing measures to facilitate intra-African travel.

Europe is anticipated to drive positive tourism results in 2024. In March, Romania and Bulgaria are scheduled to join the Schengen area of free movement, and the hosting of the Summer Olympics in Paris during July and August is expected to attract a large number of visitors.

Strong travel demand from the United States, supported by a robust US dollar, will continue to benefit destinations in the Americas and beyond. Key source markets in Europe, the Americas, and the Middle East will fuel tourism flows and spending worldwide.

However, economic and geopolitical challenges persist and can affect the sustained recovery of international tourism and confidence levels. Factors such as inflation, high-interest rates, volatile oil prices, and trade disruptions may affect transportation and accommodation costs in 2024.

In light of these challenges, tourists are expected to prioritize value for money and opt for destinations closer to home. Sustainable practices and adaptability will also play a key role in consumer decision-making.

Tourism businesses face a critical issue of staff shortages, as the industry struggles to meet the high demand for services.

Furthermore, uncertainties stemming from the ongoing Hamas-Israel conflict and other geopolitical tensions, such as Russian aggression against Ukraine, continue to weigh on traveler confidence.

Despite these challenges, the tourism industry remains resilient and focused on recovery, adaptability, and addressing evolving consumer preferences.