Electric Trucks Are Already Lower Carbon Than Rail In Much Of North America – CleanTechnica

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

In 2010, I was consulting to Canadian National Railroad, at the time with the legendary Hunter Harrison as CEO. It was one of many times my decarbonization proposals bounced off of organizations, something that’s been inordinately useful in helping me understand how hardcore businesses view the space.

At the time, CNR and all railroads had a basic statement they trotted out to anyone who actually cared about carbon emissions: our carbon emissions are a lot lower than trucks. They couldn’t make that claim for pipelines, but as 99.999% of pipeline deliveries are of fossil fuels, no one really cared.

At the time CNR was running a lot of oil cars along its routes through 10 provinces and 18 US states, stringing up to 16 cars together with connecting hoses so that oil could be pumped in and out at one end. About 70,000 cars of oil a year have been running on North American tracks, and CNR and other railroads were promoting the business as an obvious alternative when pipelines weren’t available. That was in addition to the much higher numbers of coal cars they were running, about 4 million annually. Oil could be piped, but coal couldn’t.

It’s a bit rich to brag about how low carbon your transportation mode is if your primary load is high carbon, and about 33% of North American rail loads are coal and oil. For the oil part, they are a higher carbon mode than pipelines, so once again, a bit rich.

North American railroads run on diesel. They may have electric motors on their traction wheels in their locomotives, but the electricity comes from big diesel generators fed by big tanks of diesel. They may have dynamic braking which uses the electric motors on their traction wheels to assist with braking up to 4-kilometer-long trains to slow down, but the electricity generated is shoved into heating coils on the rooftops of the locomotives to get rid of it, not stored for future acceleration.

And North American railroads have been resisting attempts to increase their efficiency for many years. Locomotives are maintained for decades past their normal expected retirements because new locomotive efficiency requirements are a bit more expensive.

North American railroads are in the logistics realm, and logistics is a low margin, high volume business. It’s an operational efficiency business, not a high growth business. They are ruthless about cutting costs below the line much more than above-the-line revenue growth. If the businesses own the tracks, they eliminate rail where possible, and only invest in lower short term costs for it when possible. Attempting to interest them in level-crossing monitors to be able to alert trains 10 kilometers away that a car was stuck on the crossing fell on deaf ears.

This explains why derailments are increasing in the US. The business model isn’t aligned with lowering human or environmental risks or impacts. It’s aligned with quarterly stock analyst reports. They don’t care about carbon emissions a few years from now, they care about what companies have done for shareholders in the past three months.

This is part of a pivot away from corporate governance historical intent since the 1970s, with GE’s Jack Welch playing a significant role, one which is only starting to unwind in the US. Elsewhere in transportation, Boeing is suffering badly in large part because four Welch acolytes have been Boeing CEOs in recent decades. For those interested in more on the damage Welch and his adherents did in this first month that General Electric is no longer on the stock exchange for the first time in 130 years, I recommend the book The Man Who Broke Capitalism: How Jack Welch Gutted the Heartland and Crushed the Soul of Corporate America — and How to Undo His Legacy.

Europe and other geographies had much lower losses of governance accountability across stakeholder groups over the same time period. The United States is returning slowly to multi-stakeholder governance instead of shareholder returns-governance in fits and starts, although it’s tough sledding and profits before anything and everything proponents are still a large and well-funded lobby group. For those interested in the longer story and where North American governance is going, I recommend The Governance Revolution: What Every Board Member Needs to Know, Now!

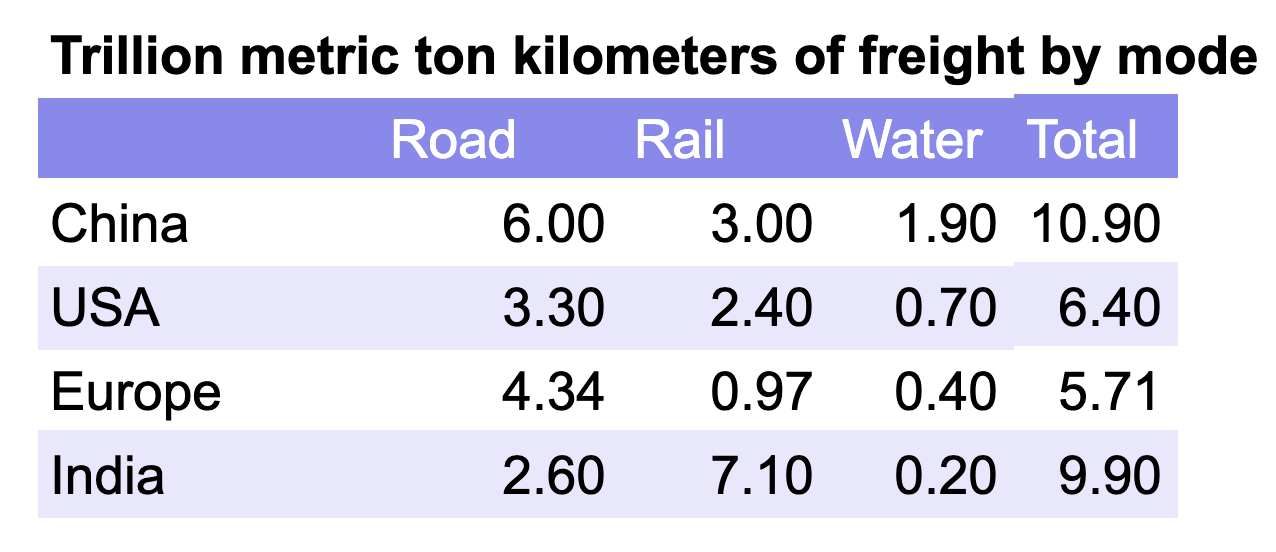

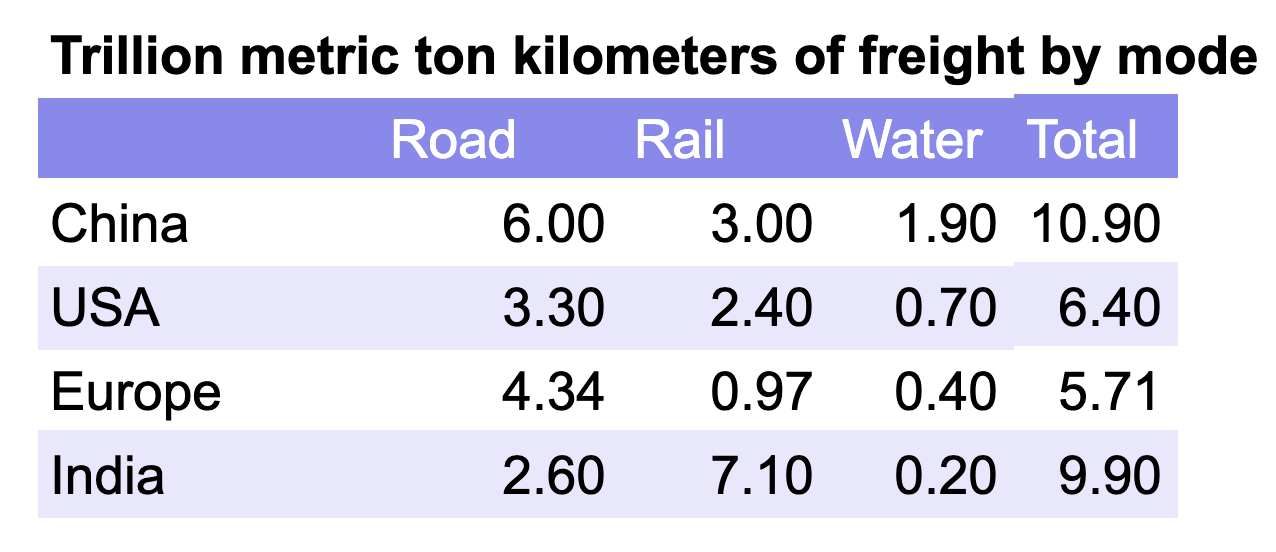

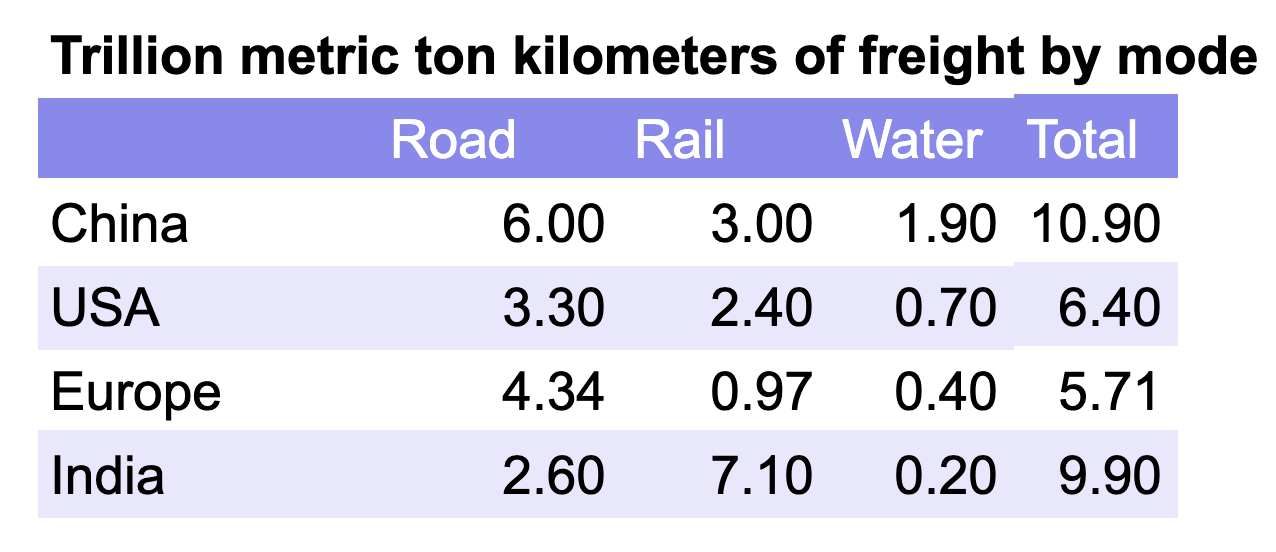

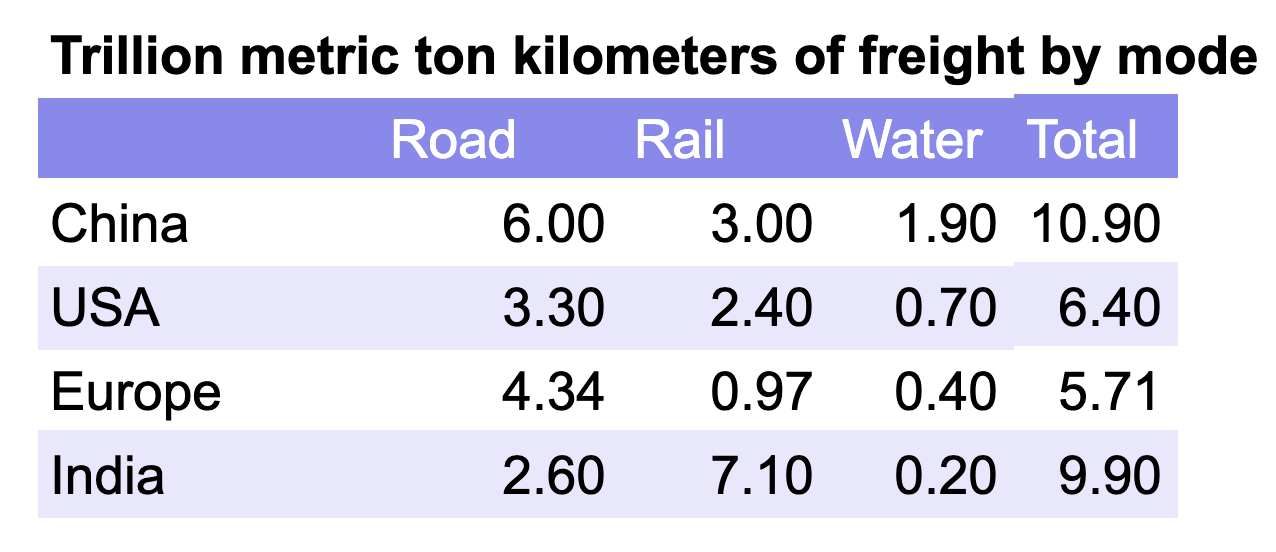

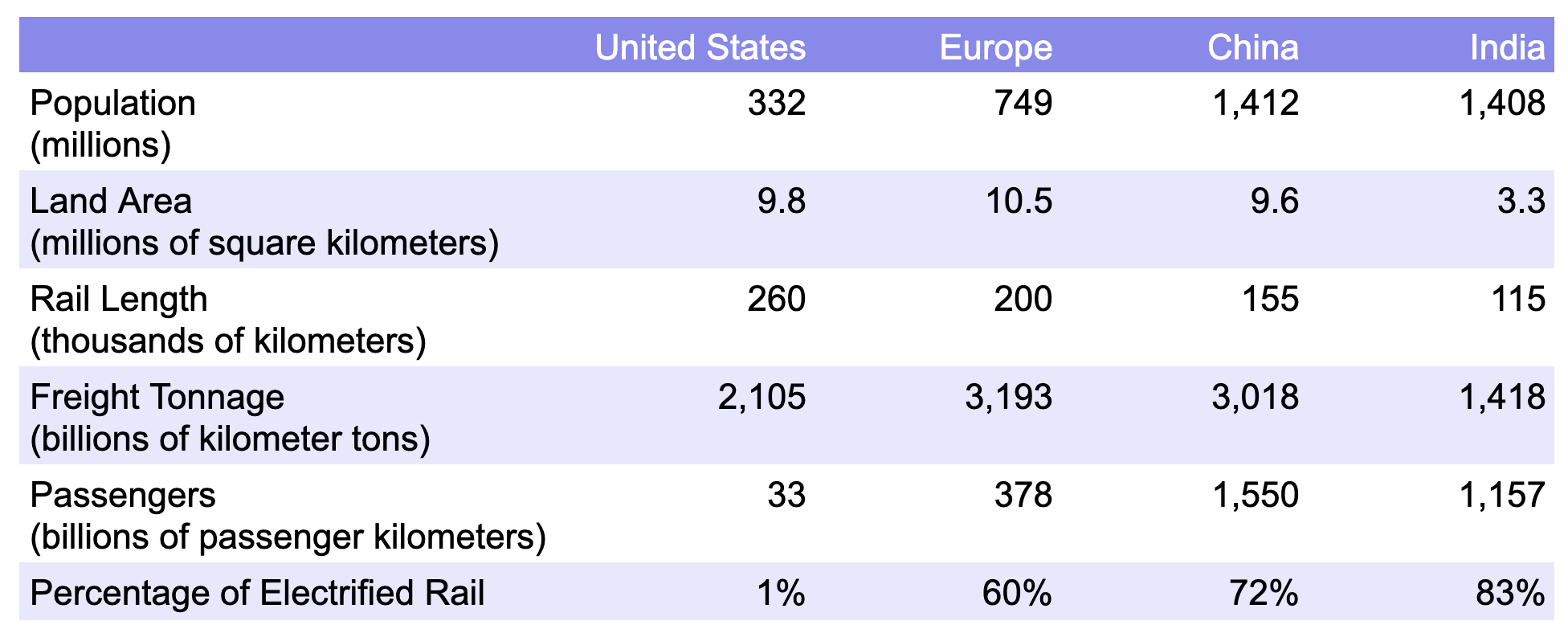

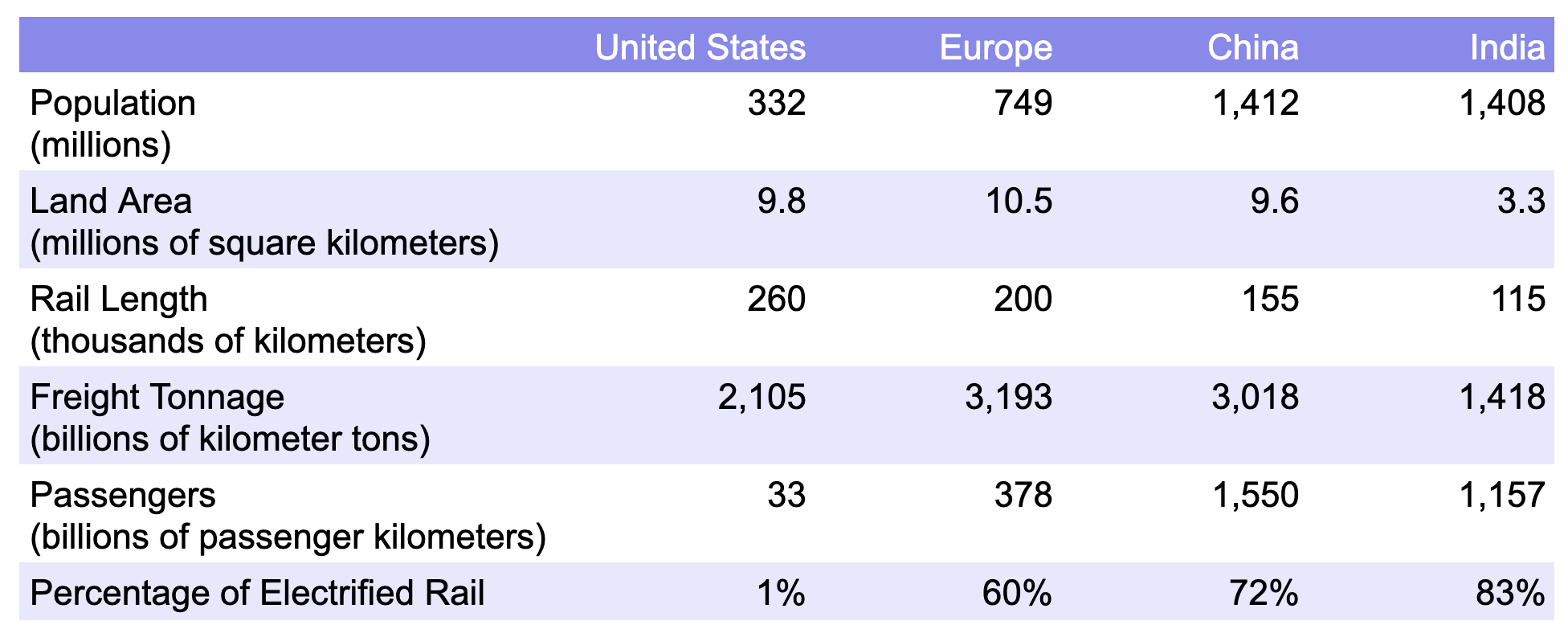

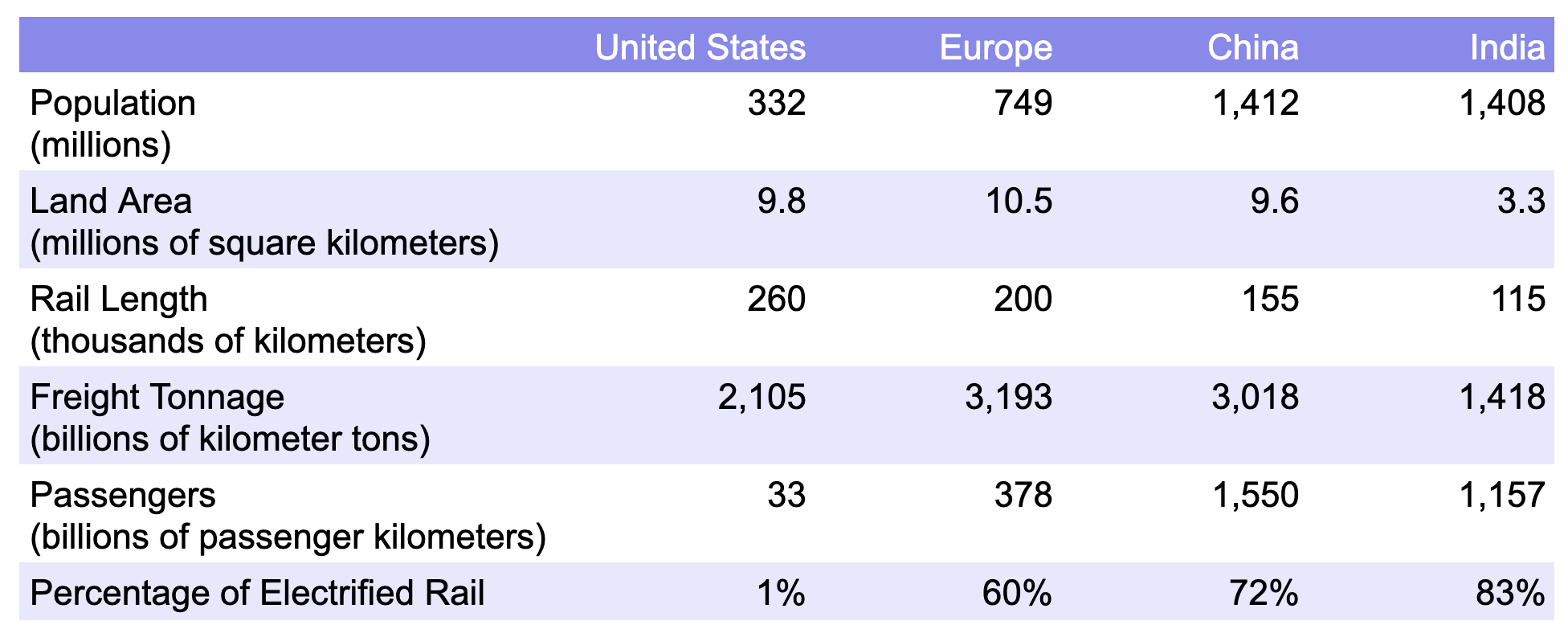

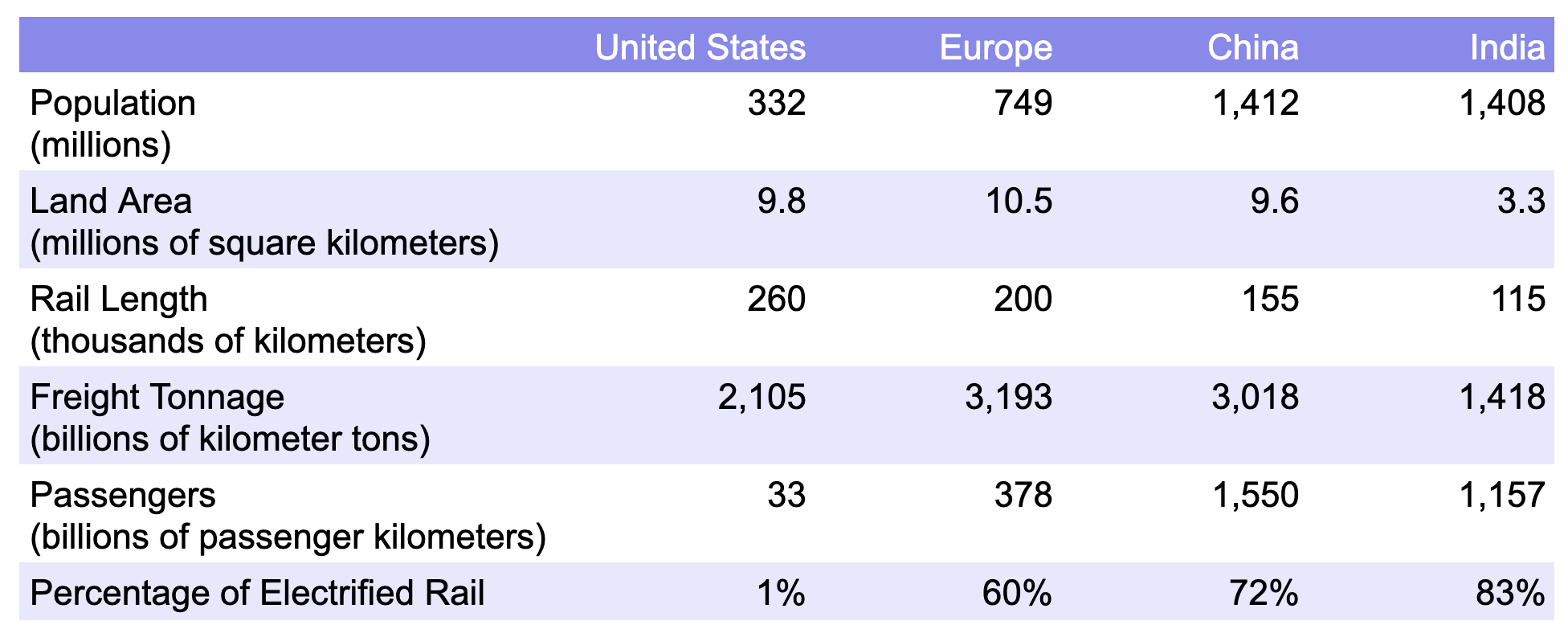

The table of domestic freight ton kilometers by mode above is one I developed recently when thinking about global variances in freight transportation mode starting points for decarbonization. Remarkably, India will be 75% complete on primary decarbonization of domestic freight this year when it completes electrification of heavy rail. China still leverages lower emissions rail and water modes more than most geographies, 75% of its rail is electrified, and its water freight is electrifying. Europe just announced much more stringent decarbonization of its road freight, with 90% decarbonization of new vehicles in 2040, which means electric trucks.

It’s in this context that a major transportation mode upheaval will be occurring in the coming decades in North America. It’s not the one the US transportation blueprint from 2023 envisages. That document is better than the US hydrogen strategy, but that’s a very low bar given how wrong-headed and misplaced that is.

The blueprint talks about mode-shifting as a primary strategy. That means respecting and pushing toward a merit order of least to highest emissions transportation, one where people live more densely and can walk, bike, and take transit for most things that they do. It means freight moves by water before rail and rail before roads. Then the blueprint talks about low-carbon energy for transportation, but has hydrogen and burnable fuels across multiple modes of transportation where they don’t have a play compared to electrification.

Each of those propositions has different challenges. Since World War Two, the US has intentionally and unintentionally created massive sprawl, building trillions in infrastructure around detached homes, highways, and personal automobiles. Some of that has been corporate strategy, with GM indicted for buying up and dismantling streetcar systems in the 1940s. Some of that was part of the nuclear war terror, with federal strategy of dispersing the population as much as possible so that in the event of a nuclear war, more Americans would survive and could rebuild. Some of it was explicitly racist, such as white flight to the suburbs enabled by a GI Bill that gave preferential mortgage rates to returning white veterans, but not to Black ones.

Unwinding that deeply wrong-headed distribution of citizens is likely impossible. As I’ve noted in the past, electric cars and heat pumps will make the sprawl relatively climate neutral, it’s only about 1% of the world’s population and that’s likely the best outcome that’s possible. North America is a massive outlier globally, with 92% of all weekday trips being by car, compared to Asia’s average of 30% and Europe’s average of 45%. Mode-shifting the movement of people in North America in this context will be papering around the edges of a yawning chasm. People who can afford to live in Boston, New York, or San Francisco will get transit, walkability, and bikeability, but the rest of the country will remain in their SUVs and pickups, albeit electric ones eventually.

Shifting freight to water in North America runs headlong into the combination of the Jones Act and the shift of heavy industry like shipbuilding to Asia. I published on this recently, noting that the Jones Act’s noble intent, to maintain a merchant cargo fleet that would serve as wartime logistics as it did in World War One (albeit to both sides for much of the war), had failed and that the Act should be abandoned. The stringent requirements of the harshest cabotage act in the world require all domestic commercial vessels for freight and passengers to be built in America, owned by American firms, crewed by American citizens, and registered as American vessels.

Meanwhile, the US has disappeared from shipbuilding globally, with the exception of military vessels. China has the lion’s share of the market with 59% of orders in 2023, followed by South Korea and then Japan, with the US not even in the top 15 countries by shipbuilding. Italy has more of the global shipbuilding market than the US does. This means that the ability to get more domestic freight onto more ships is blocked by an inability to get new vessels. Further, it means that building the battery-electric domestic freight ships of the future — all inland shipping and two-thirds of short sea shipping will electrify in my projection and others — is simply not viable either.

Naturally Biden is blaming China, but as with everything else, China for decades maintained consistent and long-lasting industrial policies aligned with where the ball will be, while the US and other countries chose to follow the trajectory of the ball, pretending that the myopic stock market would lead to the best economic and industrial outcomes. Blaming China is convenient politically, but given the massive return to favor of industrial policy in Europe and North America after decades of disfavor, it’s inaccurate.

So the mode shift of the daily movement of people won’t happen to any particular degree. And the mode shift of freight to water is sinking before it even launches. But what about ground freight?

I developed this global rail perspective at the beginning of 2023. It’s already out of date as China is up to about 75% and India is approaching 100% rail electrification. The 1% figure for the US is solely for the incredibly limited passenger rail in the country. There is no electrified freight rail in the country. As I noted at the time, the American Association of Railroads, like the lobbying group for road freight, was quite willing to bend reality to pretend that rail electrification was completely impossible.

The irony of the rest of the world quietly succeeding at what the US rail association claims is impossible shouldn’t be lost on anyone, but I thought I’d call it out explicitly anyway.

The statistics above show the problem. The US moves half or less the tonnage of freight per kilometer of track as other major geographies. That means that they have half the revenues per kilometer of track for strategic investments. That means that railroad companies aren’t keeping up with essential maintenance for safety, never mind expensive infrastructure projects like electrification.

Further, a full third of US rail is shipping coal and oil, as noted. 1.1 trillion ton kilometers of freight is disappearing from US rails in the coming years, bringing it below road freight without any other levers being pulled. That’s also revenue that’s disappearing from rail company’s ledgers, once again making investments in basic track maintenance unlikely, never mind electrification investments.

But at least rail is lower carbon than trucking, right? Not any more.

Electric trucks sip at electricity. It takes about 1.1 kWh to move the average — non-Tesla — loaded Class 8 truck a kilometer. The batteries to electric motors are much more efficient than diesel through engines and of course emit no carbon dioxide while doing so. But the carbon intensity of the electricity matters. Rail has very low rolling resistance, long trains are much more aerodynamically slippery than trucks — hence why trucks convoy and slipstream one another — and the diesel generators powering electric motors at constant speeds are much more efficient than trucks which are going up steeper grades and changing speeds much more frequently.

Every freight rail company — CNR, CKPC, BNSF, UP, CSX — has had a carbon saving calculator on their websites for a couple of decades. It was often one of the first things that they put up. Their carbon calculators have been a big part of their green credentials and why they don’t invest in any decarbonization solutions.

And they are all wrong now.

I was working on a piece for the Journal of Sustainable Marketing yesterday. The editor in chief had asked for a guidance piece for supply chain designers — supply chains and distribution channels are core parts of product differentiation strategies, and hence in marketing, along with other things that don’t sound like marketing to most people — about decarbonizing their supply chains. The radical electrification of logistics around the world was a touch point, as were the competitive implications of carbon border adjustment mechanisms and attendant carbon prices.

One of the pieces of guidance was to look realistically at different geographies’ low carbon logistics opportunities. An example I pulled together was shipping ten cars of fertilizer between Bakersfield and San Diego in California. A sample rail calculator claimed savings of 11.4 tons of carbon dioxide.

But at California’s electricity carbon intensity for 2023 of 272.4 g CO2e/kWh, delivering the same load with electric semis would result in under five metric tons of carbon dioxide, while running on rail would emit over five tons. And while California is better than the US average, it’s not even close to best of breed in North America.

Looking to Canada, where CNR and CKPC share cross-country rail freight, British Columbia, Ontario, Manitoba, and Quebec have carbon intensities that are a tenth to one two-hundredths of California’s. The route through the southern part of the country where all the people and cities are is about 5,200 kilometers wide, and those provinces are 3,500 kilometers, about 70% of it. BC, Ontario, and Quebec also have about 71% of Canada’s gross domestic product and 75% of the population, so they also have the vast majority of the freight movement, especially the freight movement that isn’t coal and oil, which are big parts of Alberta and Saskatchewan’s — the high electricity carbon intensity provinces in the prairies — freight tonnage.

There are seven US states with lower carbon electricity than California, which means that’s another seven states where electric trucking is lower carbon or a lot lower carbon than California, which is close to the breakeven point. As the US continues to decarbonize, displacing coal and natural gas with more renewables, electricity’s carbon intensity except in the most recalcitrant and recidivist states — pick a color between Red and Blue, pick any color — will be plummeting in the coming years and decade.

New York and New Jersey, economic powerhouses in the country, are close to the carbon breakeven point with electric trucking today. Likely in five years they’ll be over the tipping point.

Despite the US trucking association’s King Canute stance, the tide of electric road trucking is coming fast. NACFE’s Run on Less in September of 2023 saw two Tesla Semis run more than 1,600 kilometer (1,000 mile) work days, with other manufacturers’ trucks managing 800 kilometers. These are ranges that make 80% or more of US road freight operations viable.

That’s with current battery energy densities. The world’s biggest transportation battery supplier, CATL, is delivering batteries this year with double the energy density.

But that cost difference. Surely that will save rail? Well, batteries are the most expensive component of a truck, and battery prices are plummeting. They were under $100 per kWh of capacity at the beginning of 2024 and CATL has announced its fourth-quarter price point will be $56 per kWh. At 1.1 kWh per kilometer, a 1,000-kilometer (600 mile) range truck would require about a 1.1 MWh battery. In 2022, that might have cost $175,000. In 2023, $150,000. At the beginning of 2024, $95,000. At the end of 2024, $62,000.

Everything else about battery-electric trucks is cheaper than on diesel trucks. Electric motors are dirt simple. No transmission. Regenerative braking. No radiator. No air filter. No oil pan. The trajectory of battery prices is so rapid that all projections and studies, including the Swedish one I was involved with that was just published, are wrong about when battery-electric trucks will become economically viable compared to diesel.

Fleet statistics make it clear that battery-electric trucks have 40% lower maintenance costs than diesel trucks and 80% lower fuel costs. Those operational costs pay for a lot of batteries. And there’s more. The carbon pricing system used in California, twelve more US states, Quebec, and British Columbia allows freight operators to sell carbon credits if they are running electric trucks.

I was on a London School of Economics panel on freight logistics electrification this week. It was a North American panel. One of the other panelists had a fascinating slide. Selling carbon credits for heavy use electric trucks would provide about $51,000 in additional revenue. That $62,000 battery starts to look like pocket change when you contrast it with an additional $51,000 a year on the other side of the ledger. Return on investment of 15 months? Even Jack Welch would approve of that.

But what about the roads? Surely the heavy electric trucks will destroy the roads? I’ve had this conversation a couple of times with David Cebon, founder and director of the Centre for Sustainable Road Freight at Cambridge, professor of mechanical engineer and someone who studied this exact question for decades. The fourth power law of civil engineering, which asserts that road damage goes up with the fourth power of axle weight increases, is nonsense. It was based on a deeply flawed 1950s US study that ignored frost heave damage to the northern testing track and then miscalculated the statistical results after that.

Class 8 trucks and their weight limits are an administrative convenience as the lowest common denominator across all North American jurisdictions, including Canada and Mexico. Michigan allows trucks over twice the weight and its roads aren’t gravel. A ton of extra weight allowance for an electric freight truck is a red herring, not a meaningful discussion point.

There’s certainly a concern about more trucks on the roads, but a rather absurd percentage of today’s road freight is fossil fuels, with gasoline, diesel, and other fuel oils being second only to gravel. Just as a full third of rail’s tonnage is going away, about 15% of road tonnage will disappear as well. Shifting more freight to road traffic as it gets cheaper and lower carbon, in other words, will not necessarily result in a net increase in road freight traffic. No new highways are required.

Rail powered by diesel no longer has a major differentiator. That will turn into money as carbon border adjustment mechanisms such as the EU’s start pricing Scope 3 emissions, not just Scope 1 and Scope 2 emissions.

There’s more bad news for rail. One of its price point differentiators is labor costs. At present, they are legally required to have two staff, an engineer and a conductor, on a freight train. That can be two people on a 4-kilometer train rolling a thousand kilometers through the day and night. Naturally, in Jack Welch’s America, they are trying to eliminate the requirement for one of them, because the safety of others isn’t remotely a concern compared to improving returns to shareholders.

But road freight is going partially autonomous in the coming decades. The Tesla Semi will have platooning features extending the massive lead the company has in full self-driving, Daimler just announced that it is building autonomous features in conjunction with its electric semis and driver rest regulations will adapt around this reality. Convoys of trucks with a conductor and an engineer will be delivering more freight tonnage with lower carbon emissions and lower costs in the coming decade.

The combination means a dramatic shift in freight movement in the US, and as noted, not one remotely aligned with the US transportation blueprint. Rail freight will lose its fossil fuels and it will lose a lot of tonnage to road freight. Road freight will lose its fossil fuels, but more than make up for it by taking cargo away from rail.

Rail companies are backing themselves into a corner where bankruptcies will be the norm. I don’t imagine their shareholders will like that. As GE has dissolved year after year since Welch’s string of unparalleled success was shown to be destructive cost-cutting combined with cooking the books (pro tip: if someone says ‘financialization’, they mean what Welch did), so too will the freight rail majors. The US is somewhat powerless to prevent this due to a bunch of systemic issues, and it likely won’t be able to electrify rail until a couple of the big companies have failed and the government is forced to step in. That’s probably not before 2040 and likely 2050.

And while autonomous electric trucks will be cheaper and lower carbon than diesel rail in North America, they’ll still be more expensive logistics than electrified water and rail in major Asian economies, and electrified trucks covering the much shorter distances in Europe. The US, and hence North America, is allowing its logistics to become a competitive disadvantage.

Nonetheless, this reality of low carbon electric freight trucking inverting assumptions in the US blueprint and other mode-shifting perspectives is good news. The race to zero emissions is good for everyone, and perhaps this will awaken the North American rail sector from its slumber, recalcitrance, and strategic failures.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.

![We got to play ‘cops and robbers’ in the Chevy Blazer EV Police Pursuit Vehicles [Video] We got to play ‘cops and robbers’ in the Chevy Blazer EV Police Pursuit Vehicles [Video]](https://en.memphis-reisen.com/wp-content/uploads/2024/05/we-got-to-play-cops-and-robbers-in-the-chevy-blazer-ev-police-pursuit-vehicles-video-150x150.jpg)