EVs At 24.3% Share In France — BEVs Grow Volume 45% YoY – CleanTechnica

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

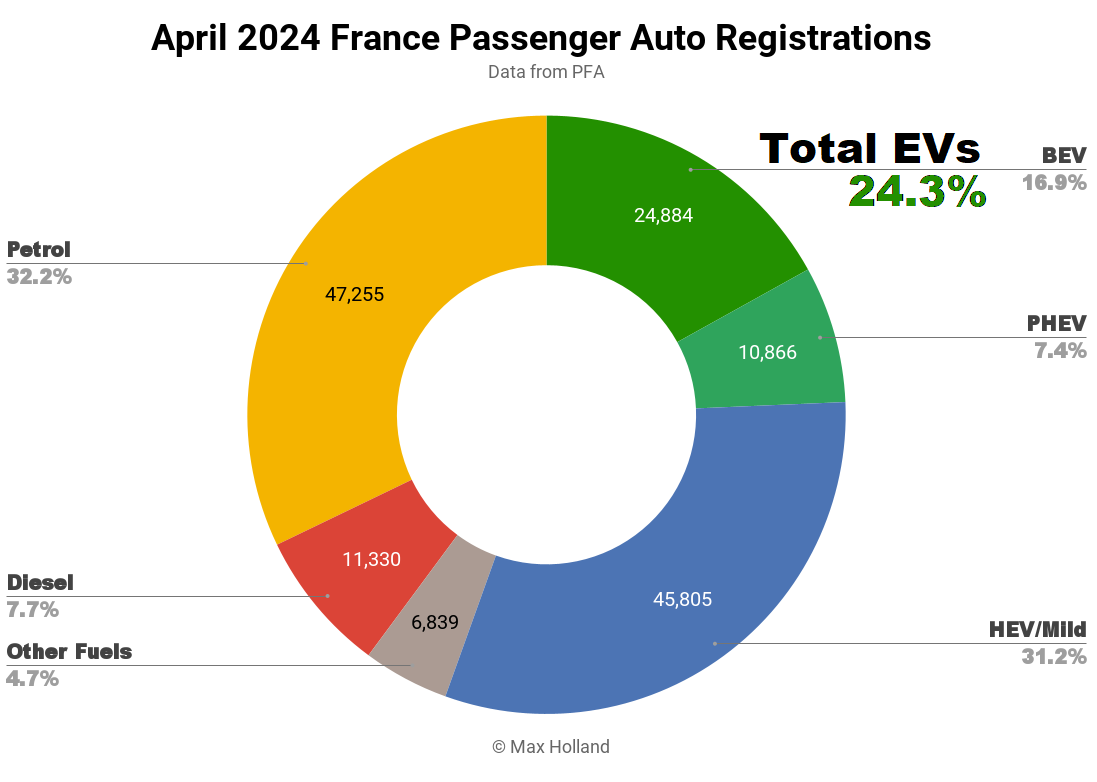

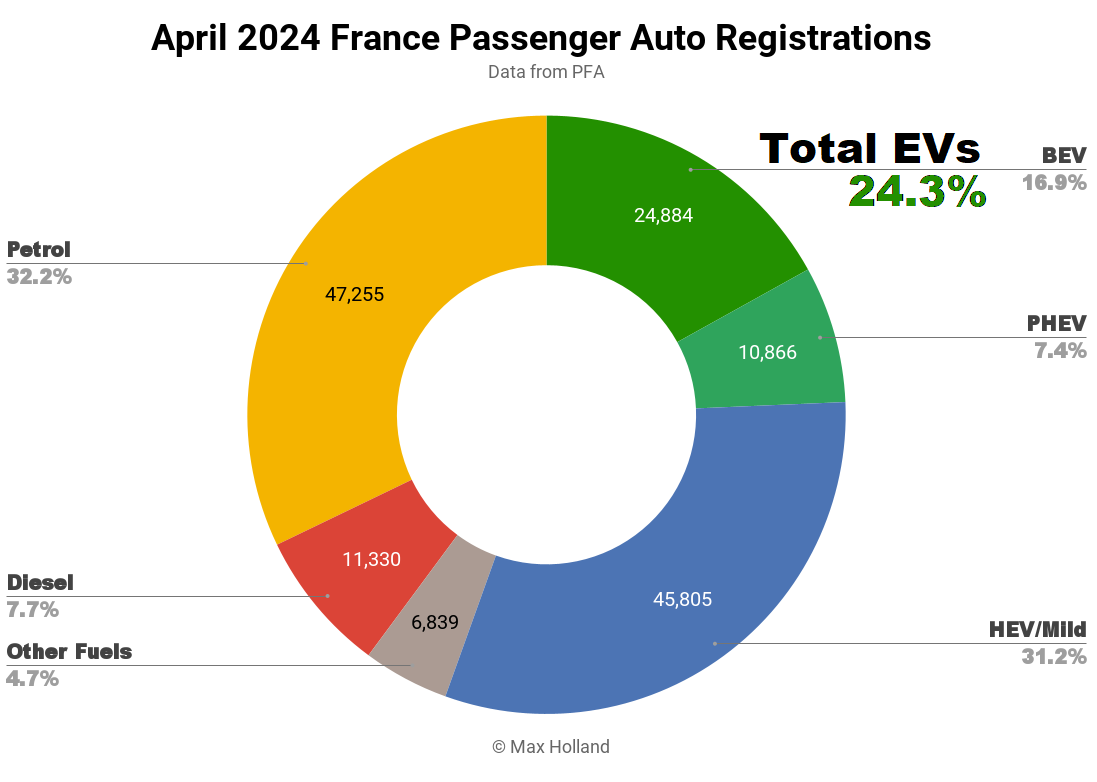

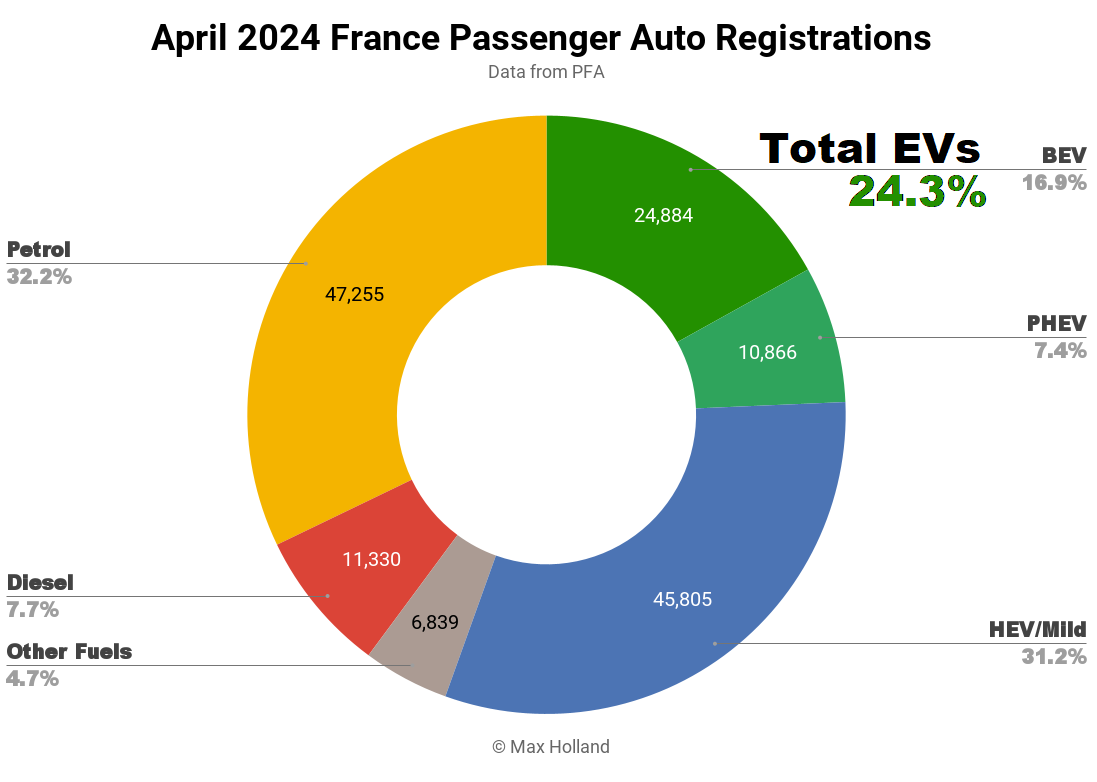

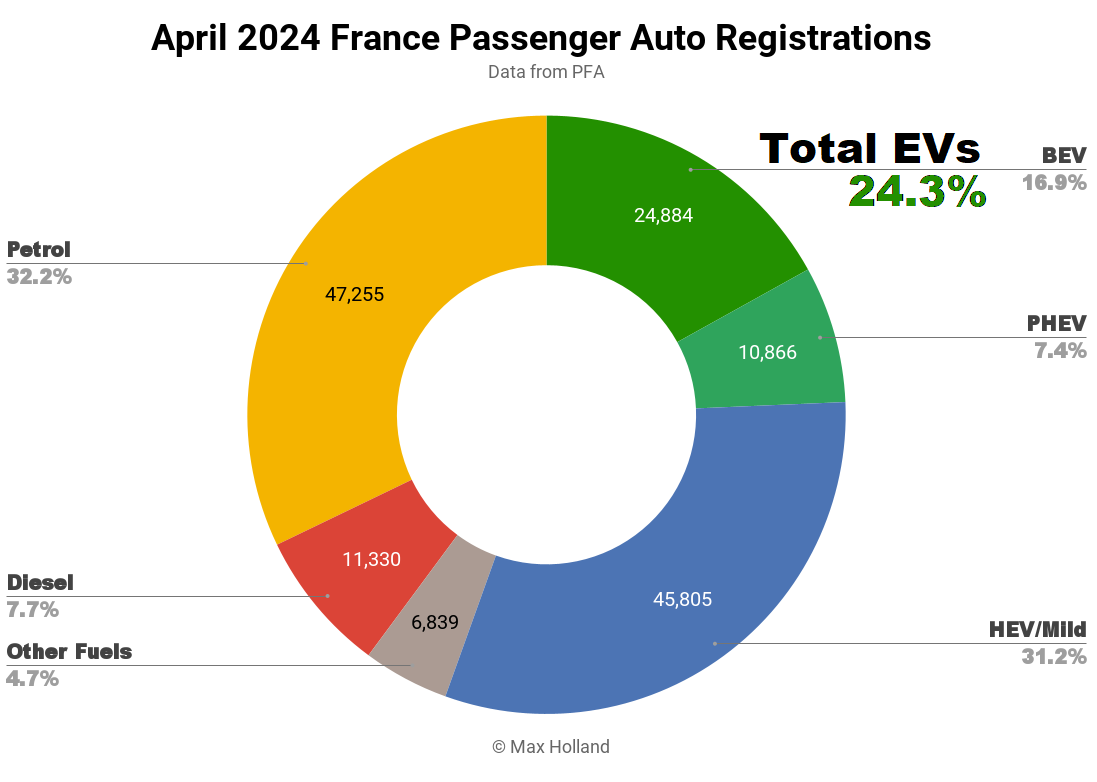

The auto market saw plugin EVs at 24.3% share in France in April 2024, growing from 21.1% year on year. Full electric volume was up by a strong 45% YoY, while plugin hybrid volume was flat. Overall auto volume was 146,979 units, up 11% YoY, though remaining below 2017–2019 seasonal norms (~185,000). The Peugeot e-208 was once again the best selling full electric vehicle.

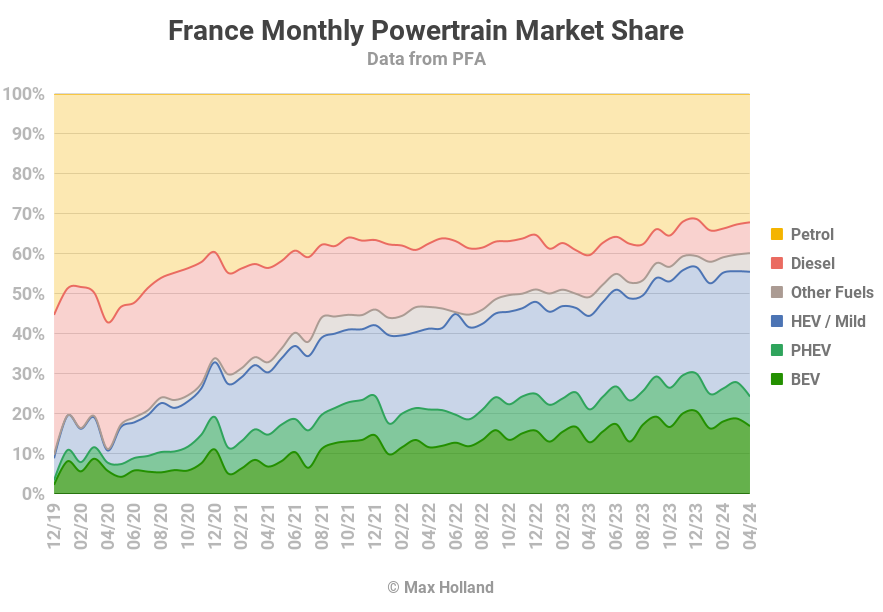

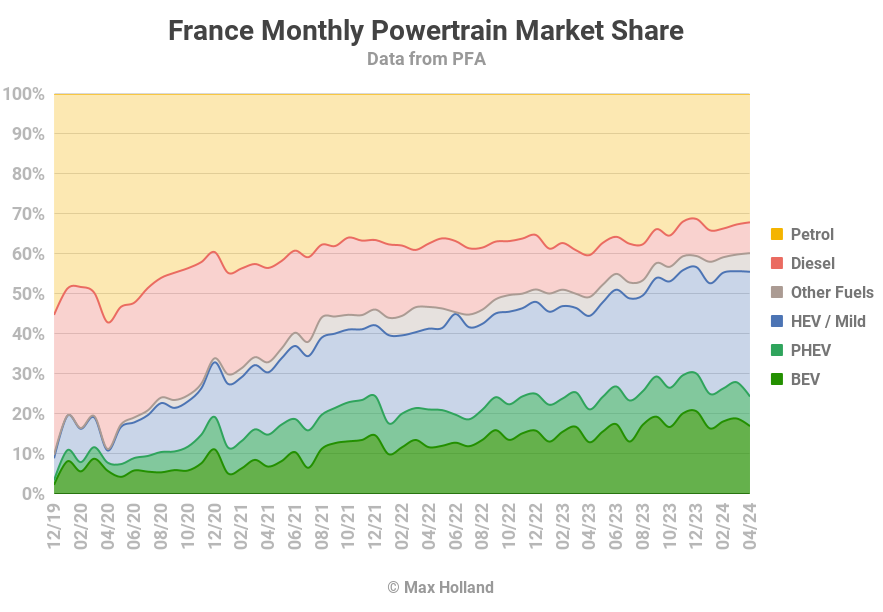

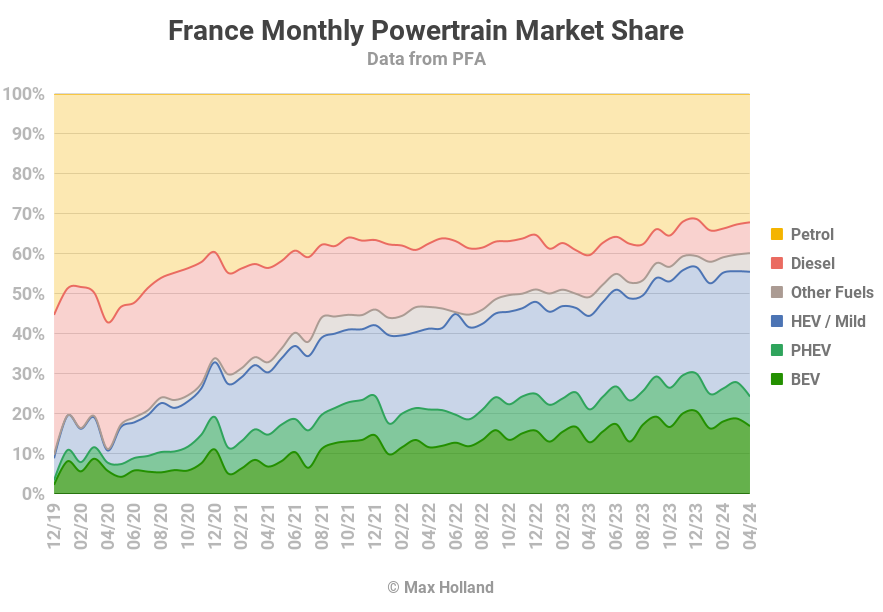

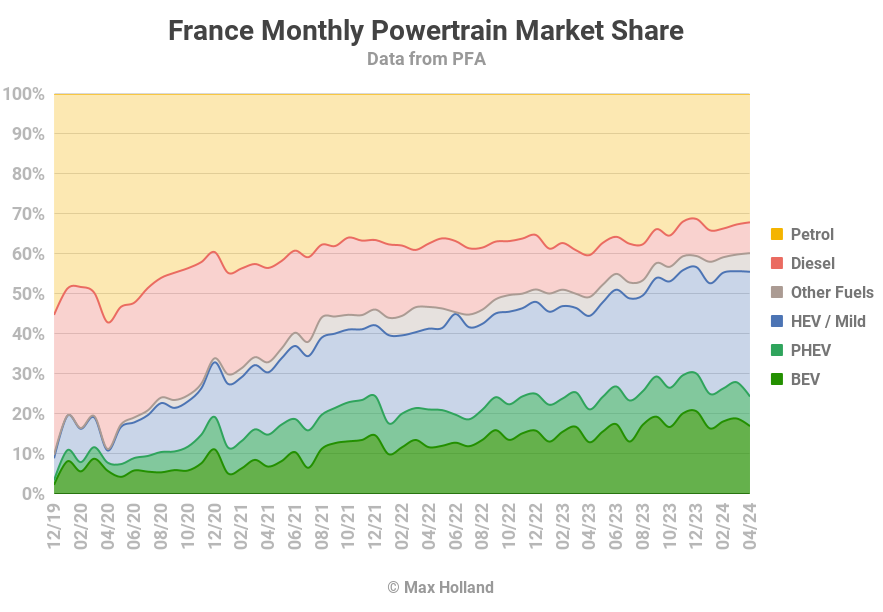

April saw combined plugin EVs at 24.3% share in France, with full battery electrics (BEVs) at 16.9% and plugin hybrids (PHEVs) at 7.4%. These compare with respective YoY figures of 21.1% combined, with 12.9% BEV and 8.2% PHEV.

BEVs climbed in volume to 24,884 units, from 17,112 year on year, a growth of 44.9%. This outperformed the overall market, which was up 11% YoY. Much of the overall auto growth was likely due to the incidence of Easter holidays, which gave the month of April two more auto selling days in 2024 compared to 2023 (11% more selling days).

The strong growth of BEVs outweighed the flat YoY volume of PHEVs, and the consequent decreased PHEV market share.

Year to date, BEVs have grown volume by 28% compared to the same period last year. This is in part due to the subsidised social leasing scheme for BEVs, which saw double the volume expected (50,000 leases in total). The push for new leasing contracts was closed off around mid February, but deliveries of those leased vehicles are still playing out, and have boosted the April figures.

On the other hand, the cutting of eco-bonus incentives to all BEVs made outside of Europe — which came into effect from March 15th — is weighing on BEV volumes. Former top 10 favourites like the Tesla Model 3, Dacia Spring, Kia Niro, and MG4 (amongst many others) are all now personas non grata in France, and are facing relative hangover.

The stop-gap technologies of HEVs and mild hybrids have also seen sales growth YoY, and have likewise taken share away from combustion-only vehicles. Diesel’s share was down to 7.7%, from 10.5% year on year.

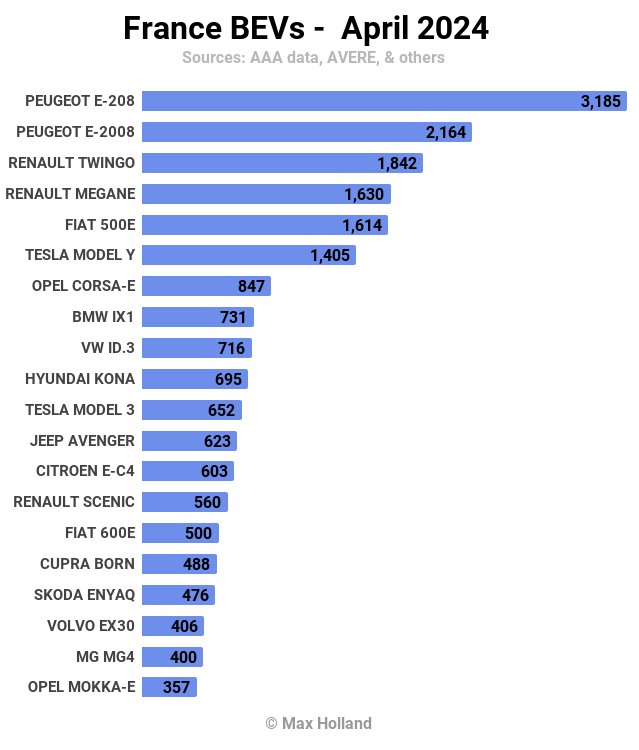

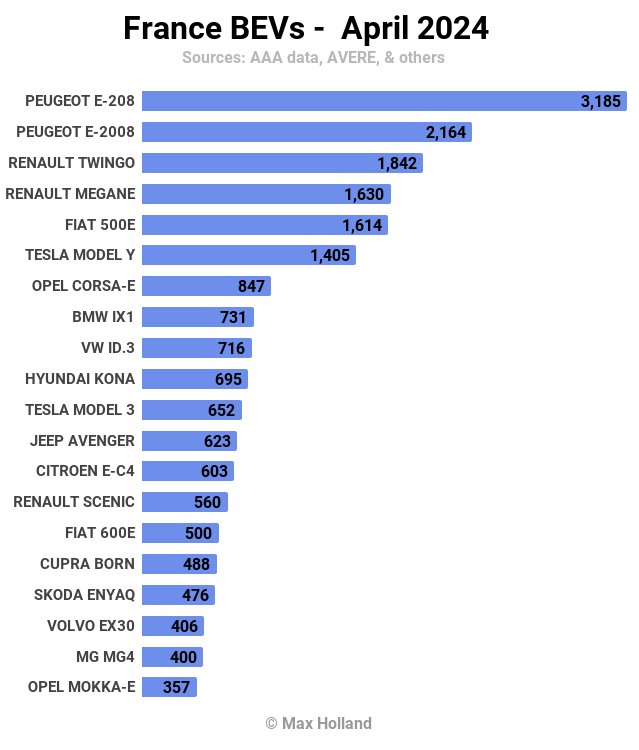

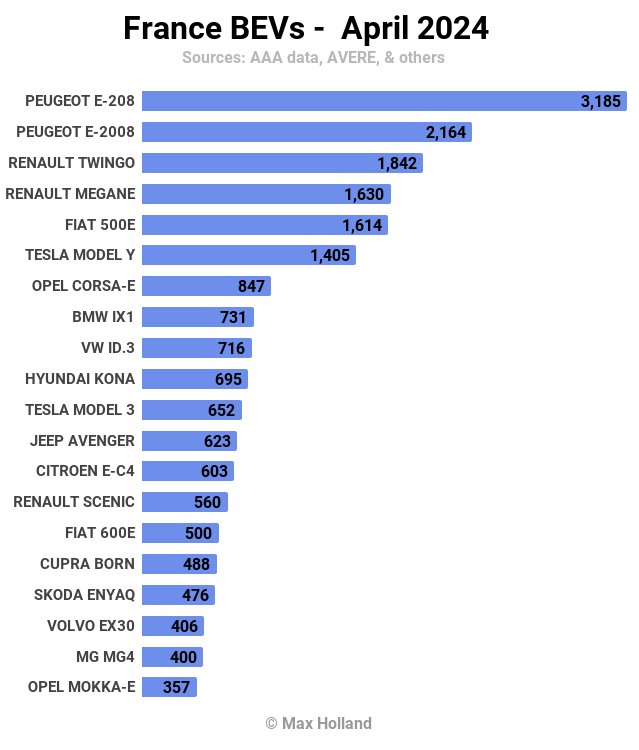

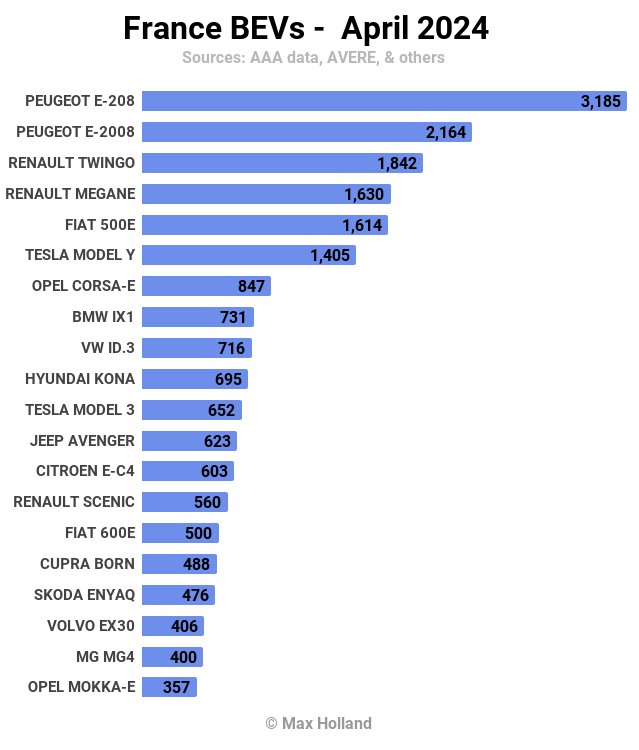

Best Selling BEVs

The Peugeot e-208 was once again the best selling BEV of the month in April, with 3,185 units registered, roughly in line with its average monthly volumes in Q1.

Its larger sibling, the Peugeot e-2008, took second place with 2,164 units, and the Renault Twingo came in third with 1,842 units.

The Tesla Model 3 fell 4 spots to 11th, the Volvo EX30 fell 10 spots to 18th, and the MG4 fell 10 spots to 19th. Built outside Europe, April was the first month that these popular models have been excluded from the eco-bonus purchase incentive — thus the fall in sales and ranking. The volume of each was roughly a third of what it was in March.

I don’t currently have model sales data beyond the top 20, but the Dacia Spring, Kia Niro, and other formerly popular models that are built outside Europe likely suffered similar volume drops.

Likewise I can’t bring you insights into debutant BEV models in April due to the limited data. We can, however, see that the new Renault Scenic, which has previously only had “teaser” volumes, saw its first strong deliveries in April, with 560 units.

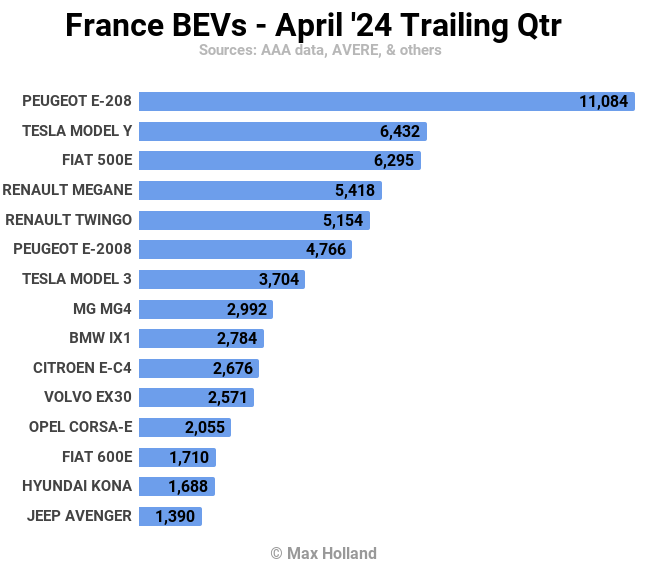

Let’s turn to the longer term view (with enough data to define the top 15 spots):

With 4 months of monthly leadership under its belt, the Peugeot e-208 has now taken a strong lead, far ahead of the Tesla Model Y, and Fiat 500e, in second and third spots respectively.

This is a big climb for the Peugeot, from just 6th place in the prior period (November to January). Another relatively strong climb has come from the refreshed Citroen e-C4, which has taken 10th, from just outside the top 20 previously.

The notable falls in rank come from the bonus-excluded models noted above — the Tesla Model 3, MG4, Volvo EX30, Kia Niro, and Dacia Spring. Is it just a coincidence that French-made models seem to be benefitting from the new rules? Let us know in the comments.

Outlook

The headline year on year auto market growth in April was modest given the extra working days, as discussed earlier. The broader French economy remains weak, though in better shape than some European neighbours. Year on year GDP output was up by 1.1% in Q1 2024, following 0.8% growth in Q4 2023. Inflation has calmed to 2.2%, the lowest level since September 2021. Interest rates are flat 4.5%. PMI, however, fell to 45.3 points in April, from 46.2 points in March.

The short term boost to BEV registrations so far this year has been largely a result of a temporary social leasing programme, with 50,000 leases signed. This will continue to boost registration numbers into May, and perhaps June, but after that, the negative influence of the bonus cancellation for many popular BEV models may begin to outweigh it.

What France needs now, for continued EV growth, is what the Chinese market has — great value BEVs which compete head to head with ICE vehicles on selling price. This price competition with ICE peers is what we’ve been told (for decades) to expect once battery prices come down below $100 per kWh, and BEVs rapidly take over the auto market.

Well, battery prices are now below $70 per kWh (at the pack level). And yet, where are the affordable BEVs? Where is the strong EV growth? Meanwhile European auto makers have been making record profits, whilst increasing their BEV prices, and also whilst simultaneously closing the doors to affordable BEV competition from outside Europe.

Does this whole situation look to you like a swindle by legacy auto markers? It certainly looks that way to me. Please join in the discussion below.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.