Aptera partner US Capital Global leads $60M investment round to reach low volume SEV production

Aptera’s new partner, financial group US Capital Global, is helping lead the solar EV startup’s latest investment round, which will offer up to $60 million in convertible notes. With this funding, Aptera hopes to complete production intent SEV builds for crash testing ahead of a (very) low-volume start of production in early 2025. Here’s the latest.

Regardless of how this all inevitably pans out for Aptera Motors, the second iteration of the solar EV startup has already demonstrated the power of the people when they believe in your product. Most of Aptera’s progress to date has been made possible by crowdfunding and other investments from reservation holders.

The company has raised an impressive $135 million from over 17,000 investors, touted by the startup as the most successful crowdfunded raise in history. However, scaling is hard for startups in the EV space, and Aptera’s journey is no different.

Although it is very much afloat, Aptera has always been refreshingly transparent about its need for additional capital to finally reach a start of solar EV production and, furthermore, scale that model to deliver its technology in mass quantities.

Following a successful Accelerator Program that secured its first 2,000 build slots to investors, Aptera ended crowdfunding in favor of new capital ventures ahead of a planned IPO, including the option for self-directed IRAs.

In May, Aptera announced it had secured the help of investment firm US Capital Group to assist after its Regulation A funding program ended on June 30, 2024. The group is moving quickly with its new partner in securities offerings and is now leading a fresh investment round to help Aptera continue solar EV development.

US Capital takes lead on $60M Aptera investment round

Per Aptera Motors, its new partner and SEC-regulated investment group US Capital have begun offering eligible parties a fresh opportunity to invest in the solar EV startup.

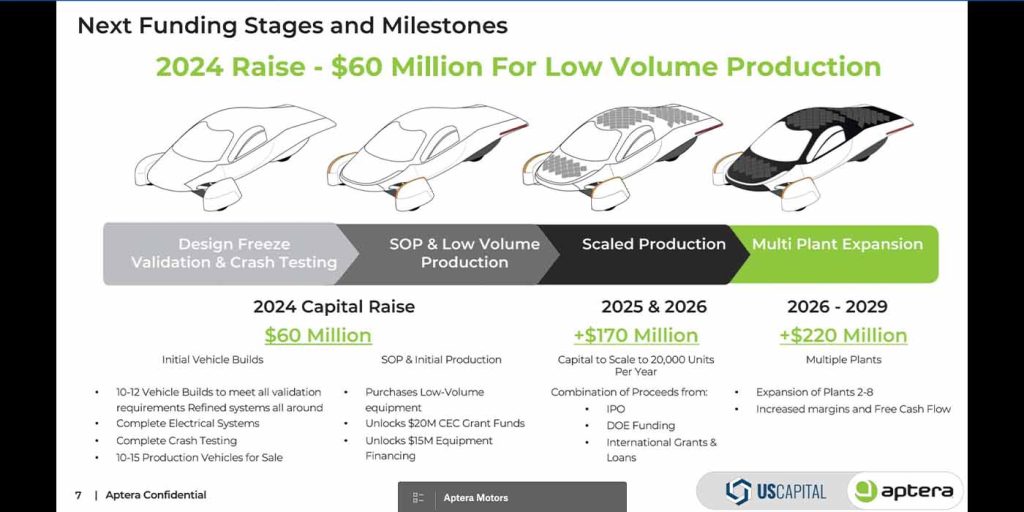

The latest round includes up to $60 million in convertible notes Aptera Motors Corp. – a figure that, according to US Capital’s Aptera investor presentation, will provide the startup with enough cash to build 10-12 validation prototypes, complete crash testing, then manufacture 10-15 production intent vehicles that will be sold. Per US Capital Global CEO Charles Towle:

With its significant patent portfolio, which includes over 34 patents in process, Aptera is committed to transforming the automotive industry. Aptera is seeking to raise $60 million in convertible notes to initiate the production of its flagship vehicle. The Company already has substantial order traction, with over 48,000 vehicle pre-orders representing more than $1.7 billion in revenue. For investors looking for opportunities, Aptera offers a compelling proposition in our view. Eligible investors are now invited to participate in this unique $60 million convertible note offering.

If successful, the 2024 capital raise should also be enough money to enable Aptera to purchase all the necessary equipment for low-volume solar EV production, which would, in turn, unlock access to previously awarded grants and financing totaling another $35 million.

Aptera’s targeted funding stages (seen above) are pretty doable compared to larger EV OEMs. However, US Capital’s investment deck still paints a picture of how difficult it will be for the startup to scale, especially at the vehicle MSRPs initially promised.

If you’re in line for an Aptera solar EV, you clearly have patience, but you will need to steel yourself further as you probably won’t see a delivery until 2026 at the earliest. Per the investment deck, Aptera only plans to sell 371 vehicles when low-volume production begins in early 2025.

That number jumps to 11,000 units in 2026 before Aptera scales to 20,000 each year thereafter.

With $1.7 billion in potential order revenue, the demand is there, and investments from those early believers have gotten Aptera Motors this far. However, the next phase will require more guaranteed capital more quickly, and that demand for funds will only grow as the startup looks to scale and hopefully make some impact on the EV industry.

As always, we will keep an eye on Aptera and its latest call for investments to keep you abreast of its progress (or failure). If you’re willing to wait a few years, you can still reserve an Aptera solar EV for only $70 down.